Markets | Natural Gas Prices | NGI All News Access | Shale Daily

Natural Gas Futures Down as Traders Weigh Production Trends, Storage — MidDay Market Snapshot

Natural gas futures traded slightly lower through midday Monday as excess inventories continued to weigh down prices despite production volumes stabilizing at weaker levels.

Here’s the latest:

- Soon-to-expire April Nymex contract at $1.640/MMBtu as of 2:07 p.m. ET, off 1.9 cents day/day but up from $1.589 intraday low

The April contract appeared to be finding support Monday at the lower 20-day Bollinger Band, according to NGI’s Pat Rau, director of Strategy & Research. “Resistance remains strong in the $2.00 level, but with April going off the board tomorrow that may not matter,” Rau said.

- Domestic production continues flowing at a slower clip

- Output flattish over weekend and into Monday at around 100-101 Bcf/d, Wood Mackenzie estimates show

- Bloomberg estimates put production at 99.6 Bcf/d for Monday

According to analysts at Gelber & Associates, recent production numbers suggest “the weakness is not maintenance-driven and more likely” reflects “continued pullbacks from upstream operators.”

- Deliveries to U.S. LNG export facilities totaling 13.1 million Dth for Monday, per NGI’s LNG Export Tracker

The Freeport liquefied natural gas terminal remained well below capacity Monday “as it limps along at a single-train rate, with Train 3 presumably the only unit online at the facility,” Criterion Research vice president James Bevan said on energy chat platform Enelyst.

- NGI modeling a 25 Bcf storage withdrawal for week ended March 22, near historical norms

Reported net changes to Lower 48 storage have landed on the bearish side of the five-year average for seven straight weeks, U.S. Energy Information Administration (EIA) data show. The year-on-five-year storage surplus has ballooned to 678 Bcf. However, NGI’s predicted 25 Bcf withdrawal for the latest EIA print would come in close to the five-year average 27 Bcf pull.

- Spot prices mixed as some regions experiencing wintry weather to start the week

- NGI’s spot gas National Avg. up 3.0 cents to $1.270, per MidDay Price Alert

The National Weather Service was calling for a “powerful storm system” to “impact the Northern/Central Plains into the Upper Midwest through Tuesday,” including snow accumulations for some areas.

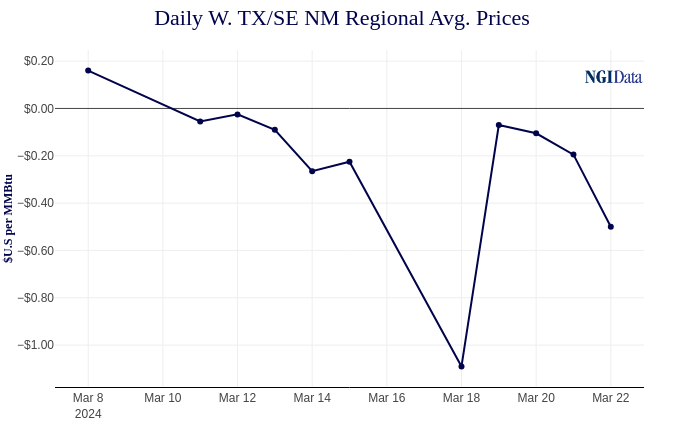

- West Texas hubs still getting thrashed with sub-zero pricing

- El Paso Permian averaging minus-68.5 cents, down 8.5 cents day/day, MidDay Price Alert data show

The W. TX/SE NM Regional Avg. has traded in the negatives since March 11, historical data from NGI’s Daily Gas Price Index show. Pipeline congestion and weak fundamentals were continuing to work against natural gas sellers in and around the Permian Basin to open the week. Wood Mackenzie noted upcoming maintenance events on the El Paso Natural Gas North Mainline that could restrict operational capacity downstream of the Permian in Arizona.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9931 | ISSN © 2577-9877 | ISSN © 2158-8023 |