Natural Gas Futures Dive Lower After Triple-Digit Storage Injection Beyond ‘Worst Expectations’

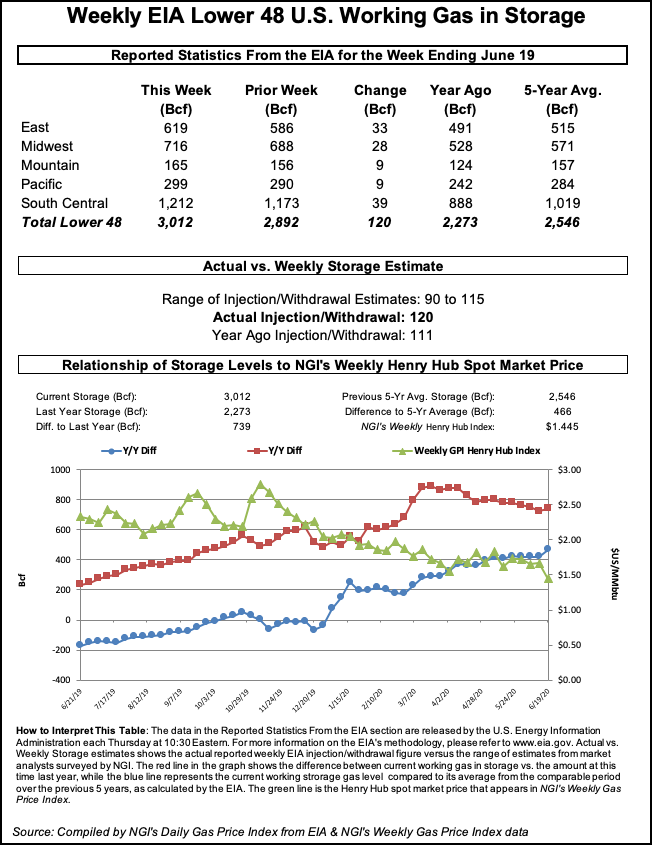

The U.S. Energy Information Administration (EIA) reported an injection of 120 Bcf natural gas storage for the week ending June 19, a bearish report that soared beyond the high end of projections, driving down natural gas futures.

The latest print was “beyond my worst expectations,” said one participant on The Desk’s online energy platform Enelyst.

Prior to the report, the July contract was down 6.0 cents at $1.537/MMBtu, and the prompt month lost more ground to around $1.521 when the EIA data was released. By 11 a.m. ET, the July contract was trading at $1.504, down 9.3 cents from Wednesday’s close.

Ahead of the report, a Bloomberg poll found injection estimates ranging from 100 Bcf to 114 Bcf, with a median of 108 Bcf. A Wall Street Journal survey produced an average build expectation of 105 Bcf, while a Reuters survey of 17 analysts produced a 90 Bcf to 115 Bcf injection range and a median of 106 Bcf. NGI estimated a 116 Bcf build.

While “hotter than normal over the central U.S.” during this week’s EIA report period, NatGasWeather said, temperatures were “cooler than normal over the western and eastern U.S.”

The uneven weather-driven cooling demand was not enough to offset still light industrial power needs amid weak economic activity and the ongoing coronavirus pandemic.

“The supply / demand balance reflected by this number is very loose,” Bespoke Weather Services said of the 120 Bcf injection.

The latest build lifted inventories to 3,012 Bcf, far above the year-earlier level of 2,273 Bcf and above the five-year average of 2,546 Bcf. A week earlier, EIA reported a 93 Bcf injection.

By region, the South Central led with a build of 39 Bcf, including a 25 Bcf injection into nonsalt facilities and a 14 Bcf build in salts, according to EIA. The East followed with a build of 33 Bcf. The Midwest posted a 28 Bcf injection, while the Pacific and Mountain inventories each grew by 9 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |