NGI The Weekly Gas Market Report

Markets | Forward Look | NGI All News Access

Natural Gas Forwards Rise on Colder Weather Outlooks; West Comes off Highs

With cold weather set to linger through at least the first part of March, natural gas forward prices strengthened across most of the country during the Feb. 14-20 period.

Most markets saw prices increase between a nickel and 15 cents, although markets out West came off a bit from last week’s rally. Given the selloff in the West, March forward prices rose an average of just one penny, while April climbed an average 6 cents, according to NGI’s Forward Look.

The general strength across the country occurred as weather models continue to point to cold conditions lingering through early March, even as much of the United States is currently in the midst of a mild spell that is expected to last several more days. The overnight weather data trended slightly colder, with the Global Forecast System data adding seven to eight heating degree days (HDD) and the European model adding five to six HDDs, according to NatGasWeather.

A large portion of the colder trend was for Feb. 27-March 5, “although what happens March 7-10 is uncertain as some of the data favors cold holding over much of the country while a second camp favors cold easing and temperatures moderating towards normal,” the firm said.

Indeed, weather models have often been at odds throughout the winter regarding the intensity and timing of cold snaps moving through the country. Bespoke Weather Services said it expects models will continue to bounce around with the exact intensity of cold in the first week of March, although “it is clear that a very significant late-winter cold shot is on the way.”

The blast of frigid air fits well with both upstream tropical forcing signal and a clear Nino-like atmospheric influence returning, the firm said. “Tropical forcing eases into the middle third of March, which is why we see gas-weighted degree days (GWDD) begin to normalize as we move towards March 10, but we still see very significant cold set to begin next week and intensify through the ensuing 10 days,” Bespoke chief meteorologist Jacob Meisel said.

As for the latest data, the midday Global Forecast System lost a little demand for late next week but remained cold Feb. 28-March 7, overall losing five to six HDDs compared to Wednesday night’s data, NatGasWeather said.

The Nymex March gas futures contract rose 6.3 cents between Feb. 14 and 20 to reach $2.636, and April climbed 5.9 cents to $2.669. The summer strip (April-October) was up a nickel to $2.76. On Thursday, the prompt month climbed another 6.1 cents to settle at $2.697, and April bumped up 5.5 cents to $2.724.

Regardless of just how intense the coming weeks of cold will be, the colder weather on tap is almost certainly expected to widen storage deficits. The Energy Information Administration (EIA) reported a 177 Bcf withdrawal from natural gas storage inventories for the week ending Feb. 15, 5 Bcf more than the highest estimate ahead of the report and a whopping 35 Bcf more than the lowest projection.

The storage number came in well above both last year’s 134 Bcf withdrawal for the week and the five-year average pull of 148 Bcf.

Bespoke, which had projected a 172 Bcf draw, said it viewed the larger pull as potentially an implicit revision of a few prior EIA prints that were significantly looser.

“Last week, we did see production and imports down with burns tightening and liquefied natural gas exports ramping — a perfect blend of bullish data for this miss,” Meisel said.

The reported withdrawal confirms that storage levels will easily dip below 1.2 Tcf and potentially 1.1 Tcf, and that at these price levels, balances are rapidly tightening, according to Bespoke. “With weather likely to remain supportive, this number confirms that $2.75 is in play for the March contract into the end of the week and allows us to maintain our slightly bullish sentiment,” Meisel said.

Broken down by region, the EIA reported a 49 Bcf withdrawal in the East, a 56 Bcf pull in the Midwest, a 47 Bcf draw in the South Central and a 17 Bcf pull in the Pacific.

The draw in the Pacific was a bullish surprise to some market analysts on Enelyst, an energy chat room hosted by The Desk. The hefty drawdown was seen as likely leading to increased volatility in a market that has already seen significant swings in recent weeks due to strong demand.

Working gas in storage as of Feb. 15 stood at 1,705 Bcf, 73 Bcf below last year and 362 Bcf below the five-year average.

Despite the growing deficits, analysts remain confident in production’s ability to refill storage this summer. Already, production is about 9 Bcf/d higher year/year and is expected to grow even further, especially once the summer gets under way. Before then, supplies will ramp up once cold weather abates, particularly in the Rockies, where more than 0.5 Bcf/d of production remains offline due to freeze-offs.

Meanwhile, the latest rig count data from DrillingInfo shows that the total U.S. rig count increased by two for the week ending Wednesday. The Permian Basin added five rigs, while the Anadarko added three. Those gains were offset by rig declines in the the Denver-Julesburg, Eagle Ford and Williston plays.

Interestingly, lateral lengths have been getting longer in the Permian during the last several years, DrillingInfo noted. From 2015 to 2017, the average lateral length was 8,200 feet in the Midland Basin, was 5,800 feet in the Delaware Basin and was 1,900 feet in the Central Basin Platform. Wells drilled in 2018 drastically increased to 9,114 feet (11% increase) in the Midland, 7,055 feet (21% increase) in the Delaware and 5,441 feet (188% increase) in the Central Basin Platform.

“With operators becoming more efficient every year, it will be interesting to see where the ideal lateral lengths end up,” DrillingInfo analyst Drew Nixon said.

Still, based on current weather forecasts, similar withdrawals like the one announced Thursday could be reported for each of the next four reports, with an average withdrawal near 160 Bcf, according to Mobius Risk Group. If recent weather forecasts verify accurately and the pattern is extended through March, the typical spring rally could begin earlier than usual.

“However, the term ”usual’ is used loosely as end-of-March inventory levels have varied by more than 1.5 Tcf in the past five years and by as much as 1.1 Tcf in the past three years,” Mobius analysts said.

West Forwards Plunge

Most pricing hubs across the United States put up gains that were relatively in line with Nymex futures, although parts of the Northeast, Midcontinent and Midwest posted slightly stronger increases due to strong cash prices earlier in the week as snow and ice blanketed those regions.

Algonquin Citygates March prices jumped 12 cents from Feb. 14-20 to reach $4.449, April climbed a nickel to $3.419 and the summer picked up 8 cents to hit $2.85, according to Forward Look.

Out West, however, forward prices retreated a bit from last week’s rally that lifted prices at the front of the curve by more than $1 in the Rockies and California. During the Feb. 14-20 period, much of those gains were taken back as the chilly, wet weather that has hammered the region in recent weeks was seen easing a bit after the next week or so.

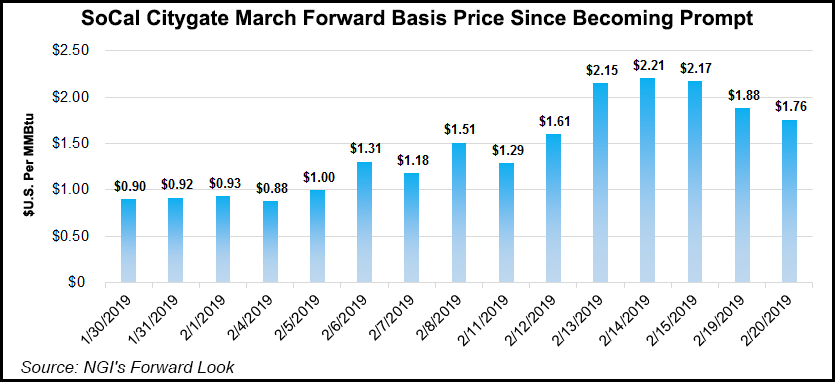

SoCal Citygate March prices plunged 39 cents to $4.396, while April dropped a far more modest 4 cents to $3.194. The summer strip, meanwhile, jumped 8 cents to $3.95, Forward Look data show.

The strength in the summer strip, which was in line with increases seen at pricing hubs across the country, comes as Southern California Gas’ (SoCalGas) Aliso Canyon storage facility continues to operate with hefty restrictions in place. Meanwhile, demand in the state and in neighboring regions has been strong, and SoCalGas on Thursday extended a mandatory power conservation effort in its service territory.

In addition, El Paso Natural Gas on Tuesday declared a force majeure on its Mojave Pipeline, restricting 220 MMcf/d of Arizona-to-California imports at the Topock Unit 3 compressor station. It was just the latest force majeure on the system due to an equipment failure at the problematic compressor station. No end date has been provided.

Over in the Rockies, Northwest Wyoming Pool March prices tumbled 68 cents from Feb. 14-20 to reach $3.2698, while April picked up 2 cents to hit $2.315 and the summer tacked on 9 cents to $2.34, Forward Look data show. Opal priced similarly.

Prices across the border in Western Canada strengthened for the second week in a row as the frigid conditions have driven up demand in recent weeks. NOVA/AECO C March prices climbed 14 cents to $1.576, although April slid 2 cents to $1.015 and the summer strip fell a penny to 98 cents.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 | ISSN © 1532-1266 |