NGI Data | Markets | NGI All News Access

NatGas Cash Unchanged, But Thin Storage Build Launches Futures

Physical natural gas for Friday delivery was unchanged on Thursday as modest setbacks in the Southeast, Midcontinent and Midwest were countered with gains in Texas and Louisiana.

The NGI National Spot Gas Average remained flat at $2.63. The Energy Information Administration (EIA) in its 10:30 a.m. EDT release of inventory data reported a refill of a lean 36 Bcf, about 10 Bcf less than expectations, and that was enough to bring the bulls off the bench. At the close, October had risen 13.0 cents to $2.806 and November was up 10.6 cents to $2.917. October crude oil soared $2.12 to $47.62/bbl.

Once the EIA figures sliced through the market, traders lost no time bidding the market higher. October futures reached a high of $2.790 immediately after the figures were released, but by 10:45 a.m. October was trading at $2.774, up 9.8 cents from Wednesday’s settlement.

“We were hearing 43 Bcf and are trading above $2.75, which might be an indication of a little boost,” said a New York floor trader.

Analysts were a little miffed by the miss. “It was hotter last week and you had Labor Day weekend which everybody tends to screw up,” said John Sodergreen, editor of The Desk Tealeaves report.

“I was originally thinking kind of a high surprise, but then I torqued it down a little bit. I was thinking 42 to 44 Bcf and that was about where the market was, and this is about 5 Bcf less. We’ll give the miss to the holiday effect. I went back years and years and found that folks tend to undershoot anyway, and that makes sense.”

“The 36 Bcf net injection into U.S. natural gas storage for the week ended Sept. 2 was less than expected,” said Tim Evans of Citi Futures Perspective. “It followed a larger than expected 51 Bcf refill in the prior week, suggesting either some shift at the margin between the two reporting periods or greater sensitivity to temperatures than anticipated. Production losses from the Gulf of Mexico may have played a small role, but we note that maximum offline was 360 MMcf/d.”

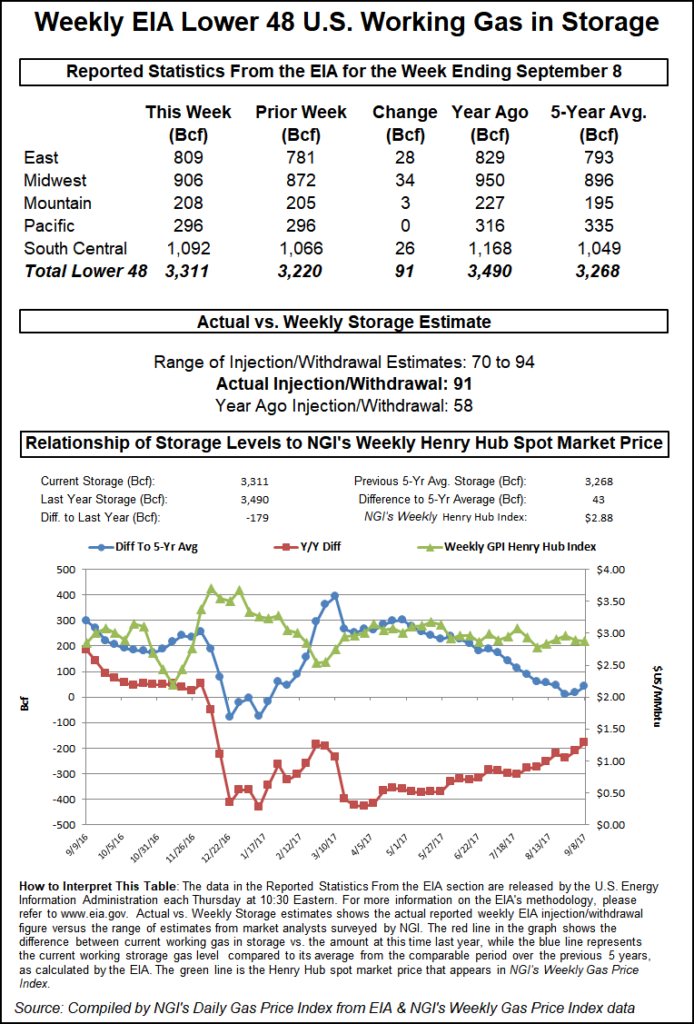

Inventories now stand at 3,437 Bcf and are 196 Bcf greater than last year and 306 Bcf more than the five-year average. In the East Region 16 Bcf was injected and the Midwest Region saw inventories increase by 24 Bcf. Stocks in the Mountain Region rose 2 Bcf, and the Pacific Region was up by 3 Bcf. The South Central Region dropped 9 Bcf.

The 51 Bcf injection reported last week was on the high side and caught traders by surprise as it was outside of all the estimates polled by Reuters. The highest the Reuters survey showed was 48 Bcf, and this week could have come in high as well.

Last year, a plump 79 Bcf was injected, and the five-year pace stands at 64 Bcf. This week traders were caught off guard by a low build. IAF Advisors calculated a 41 Bcf increase, and industry consultant Bentek Energy, utilizing its flow model, was figuring on a 45 Bcf injection. A Reuters survey of 19 industry cognoscenti showed an average of 43 Bcf with a range of 35 to 51 Bcf.

“Last week’s big build came largely by way of a bigger-than-expected build in the Midwest region — this was easily 5 Bcf higher than anybody had expected,” Sodergreen said. “This week we see a slightly different scenario. The experts say that last week’s weather was about 7% warmer than the five-year average and 5% warmer than last year, same week.

Forecasters see an eventual return to normal injection patterns. “[A]fter natgas demand again increases to stronger than normal levels this week, a more seasonable pattern is expected to become established for the second half of September where much of the natgas demand will be driven by the warmer southern U.S.,” said Natgasweather.com in an update. “There have yet to be any signs of significant early season cool fronts coming to the northern U.S., which overall will keep weather sentiment bearish as larger builds in supplies arrive, a few of which will finally be near normal.”

In physical market trading eastern points showed the greatest movement and that was lower as peak power loads were forecast to decline. The PJM Interconnection forecast Thursday’s peak load of 53,929 MW would ease slightly Friday to 53,489 MW and reach 48,717 MW Saturday. The New York ISO predicted New York City’s peak load Thursday of 9,536 MW would rise to 9,906 MW Friday before sliding to 48,717 MW Saturday.

Next-day gas deliveries on Tetco M-3 fell 2 cents to $1.46, and gas bound for New York City on Transco Zone 6 shed 13 cents to $2.70.

Gas at the Algonquin Citygate was quoted 18 cents lower at $3.48, and deliveries to Iroquois Zone 2 skidded 22 cents to $3.30. Gas on Tenn Zone 6 200L fell 11 cents to $3.45.

Major market hubs experienced prices moving within just a few cents of unchanged. Gas at the Henry Hub changed hands 2 cents higher at $2.84, and packages at the Chicago Citygate were unchanged at $2.81. Gas on El Paso Permian added 6 cents to $2.62 and parcels at the PG&E Citygate rose 3 cents to $3.27.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |