NGI Data | Markets | NGI All News Access

NatGas Cash Catches Up With Sleepy Futures; September Inches Higher

Physical natural gas for weekend and Monday delivery took a solid jump Friday as it attempted to catch up with Thursday’s futures move of more than 20 cents. Gains in the Rockies, Northeast and Gulf were able to easily offset soft California pricing and a weak Southeast.

The NGI National Spot Gas Average added 13 cents to $2.66, but in the Northeast average increases of more than 30 cents were seen. Moves in the physical market were easily able to overtake what seemed to be somnambulant futures trading. At the close September had managed a three-tenths of a cent gain to $2.876 and October had risen eight-tenths of a cent to $2.917. September crude oil managed to stem its series of recent losses and rose 46 cents to $41.60/bbl.

Southern California prices were all over the map as temperatures were forecast to be at more normal levels and SoCal pricing returned to more normal levels. AccuWeather.com forecast Friday’s high in Los Angeles of 89 degrees would subside to 85 Saturday and 84 Monday, right at the seasonal average. Normally toasty Burbank’s Friday maximum of 94 was expected to slide to 90 Saturday and 88 Monday. Also right at its seasonal norm.

Gas at Malin rose 8 cents to $2.77, and PG&E Citygate deliveries added 15 cents to $3.26. SoCal Citygate prices plunged 18 cents to $3.02, and gas priced at the SoCal Border Avg. Average shed 19 cents as well to $2.93.

Gas on El Paso S. Mainline/N. Baja fell 9 cents to $3.05, and Kern Delivery gave up 19 cents to $2.95.

Once temperatures subside, gas prices will usually follow. “Today is a good example of gas for the 1st of August. PG&E Citygate is at $3.26 and SoCal Border Avg. is about $3.05. PG&E is over SoCal and once the heat goes away everything is going to switch back around,” said Jeff Richter, principal with EnergyGPS, a Portland, OR-based power and gas consulting firm.

“Socal will go right back to the [Henry] Hub. It’s a little over now, but come September and October it will be tight.”

Other market centers were more uniformly higher. Gas on Transco Zone 6 bound for New York City gained a stout 38 cents to $2.04, and deliveries to the Chicago Citygate added 18 cents to $2.87. Gas at the Henry Hub also changed hands 18 cents higher at $2.94, and deliveries to Opal came in a dime higher at $2.73.

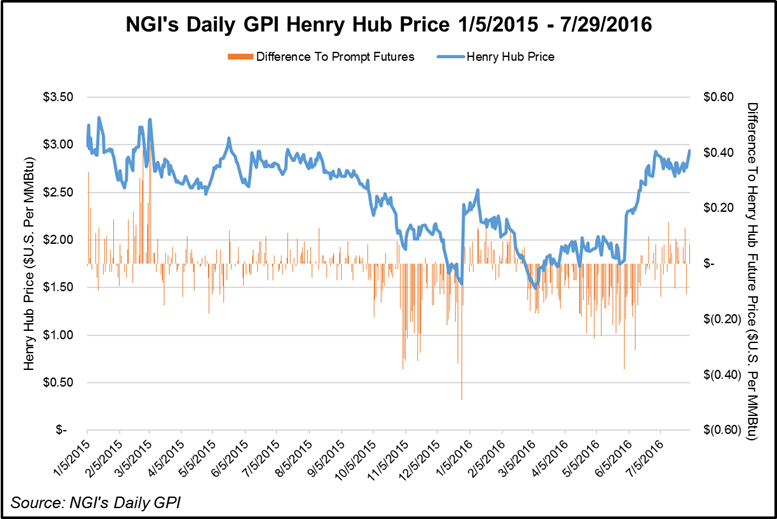

Several points set one-year highs. Katy eased past its previous one-year high by a penny to $2.91, and gas at the Houston Ship Channel traded $2.95, or 5 cents above its previous one-year high. The $2.94 Henry Hub price was a penny higher than its previous one-year high.

Top traders are looking for a spot to sell. “We have indicated this week that the one- to two-week outlooks didn’t appear to justify September values below the $2.70 level,” said Jim Ritterbusch of Ritterbusch and Associates in closing comments Thursday. “With the eastern half of the U.S. apt to see some significantly warmer than normal trends developing within the six- to 10-day time window, some additional sharply reduced injections would appear to lie ahead well into next month.

“[Thursday’s] 17-Bcf injection was well below average industry ideas as well as our own outlook for a 31 Bcf build. As a result, the surplus against five-year averages shrunk another 44 Bcf and is likely to see a similar reduction again in next week’s data. This appeared to offer a setting for today’s price spike as the market responded assertively to the upside off of the bullish combo of a comparatively modest injection and bullish adjustment to the temperature outlooks.

“We had been looking for a bearish storage figure that would offer a buying opportunity below the $2.60 level. However, today’s advance forces us to consider the short side of the market given our extended perception of the choppy/sideways trade with nearby values generally fluctuating between the $2.70-2.85 level across most of next month. In sum, we are staying in a neutral camp for now but may look to approach the short side on a further price advance toward the highs seen at the start of this month.”

Gas buyers for weekend and Monday packages across the MISO footprint looked to have relatively mild conditions to work with, but that all was expected to change in the coming week. “An upper-level disturbance pushing across Canada will push a weak cold front across the region during the [weekend], resulting in a period of seasonably cool temperatures today and tomorrow,” said WSI Corp. in a Friday forecast. “This cold front will support scattered thunderstorms throughout the period. High temperatures will run in the 70s-80s through the weekend.

“However, models are indicating a return of hot and humid weather next week where temps should jump back into the upper 80s and 90s. A northerly flow will promote wind generation near 2-3GW today into tomorrow. Wind gen is expected to become more favorable Sunday-Monday, where output could peak between 4-6GW.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |