Natural Gas Prices | E&P | NGI All News Access | NGI The Weekly Gas Market Report | Shale Daily

Midcontinent, Rockies Executives Forecasting Mild Natural Gas Price Improvement as Activity Slows

U.S. natural gas prices have hit a floor and should strengthen modestly over the next six to 24 months, according to oil and gas executives surveyed by the Federal Reserve Bank of Kansas City.

The Kansas City Fed, as it is better known, conducts a quarterly survey to gauge current and expected drilling activity in the Tenth Federal Reserve District, as well as its expectations for natural gas and oil prices. The Tenth District includes Colorado, Kansas, Nebraska, Oklahoma and Wyoming, along with 43 counties in western Missouri and 14 counties in northern New Mexico.

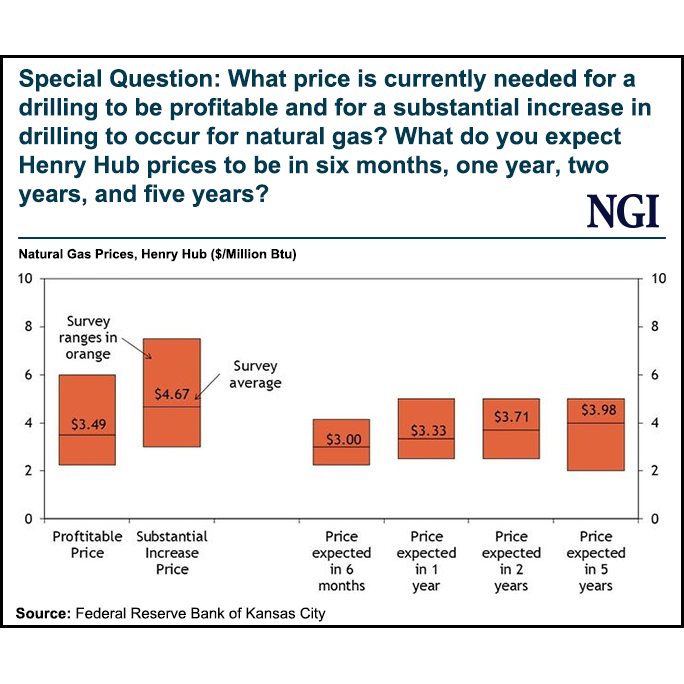

Respondents were asked to forecast the Henry Hub natural gas price in six months, one year, two years and five years.

The average expected prices for those intervals were $3.00, $3.33, $3.71 and $3.98/MMBtu, respectively.

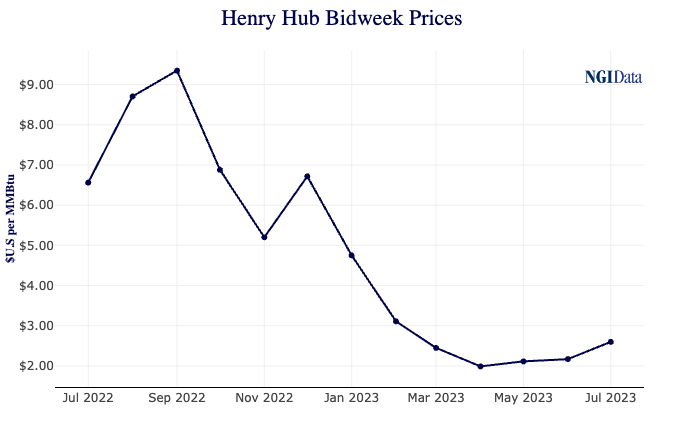

By comparison, NGI’s Daily Henry Hub Price averaged $2.490/MMBtu on Friday (July 14), and has not surpassed $3.00 since January. In July bidweek trading, NGI’s Henry Hub price averaged $2.600, compared to $6.560 for July 2022.

Natural gas forward prices mostly rose week/week during the July 6-12 period amid declining production and sweltering heat.

Survey participants shared some theories about what’s been keeping prices down, and what could boost them going forward.

“The traders have believed the recession talk and have hurt commodity prices,” one respondent was quoted as saying. “The fundamentals still show energy use increasing. Oil and gas are a big part of filling that need.”

A fellow executive wrote, “Current low inventory levels leading to strength in six-month time frame, demand slowing and longer term supply increasing over the two-to-five year time frame.”

Another said, “Gas seen as longer-term pillar in energy transition. Still lots of known supply available.”

The survey tracks indicators of energy activity including drilling, capital spending and employment.

Sluggish Prices, Demand

Tenth District energy activity slowed in the second quarter and is expected to decline further, weighed down by sluggish commodity prices and demand, researchers found.

“District drilling and business activity continued to decline in the second quarter as commodity prices remain weak and profits decline further,” said the Kansas City Fed’s Chad Wilkerson, senior vice president. “Meanwhile, employment activity picked up and is expected to remain expansionary.”

Executives said on average that they would need to see a natural gas price of $3.49/MMBtu for drilling to be profitable in the fields where they operate. For drilling to increase “substantially,” prices would need to average $4.67.

Prices, though, aren’t the only factor holding back producers. “Our company could do more and would do more if we could find quality people,” said one respondent.

The survey’s drilling and business activity index fell from minus 13 in the first quarter to minus 19 in the second quarter, according to the survey, which took place between June 15 and June 30.

The lone bright spots for the industry were the number of employees and employee hours indexes, which both increased. All other indexes declined.

“Drilling/business activity, supplier delivery time, and total profits crossed into negative territory on a year-over-year basis, while the total revenues index declined further from minus 10 to minus 48,” Kansas City Fed researchers said.

Expectations for future activity also declined, with the future drilling/business activity index falling from minus 13 to minus 22. Respondents did indicate, however, that they expect declines in revenue and profits to moderate over the coming months, in line with their expectation of higher prices.

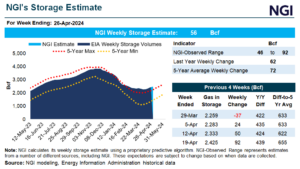

The U.S. Energy Information Administration, for its part, is modeling a 100 MMcf/d decline in Lower 48 onshore natural gas production from July to August, reflecting slowdowns in several major plays.

The U.S. rig count also dropped five units sequentially for the week ended July 14, according to the latest Baker Hughes Co. tally.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |