Mexico’s natural gas production is helping to meet national demand as U.S. prices continue to soar this summer.

“Mexican dry gas output is ramping up again,” WoodMackenzie analyst Richardo Falcón told NGI’s Mexico GPI.

Since July 21, dry gas production has averaged nearly 2.5 Bcf/d, up 0.24 Bcf/d above average levels seen for the past two months. This includes a year-to-date record high of 2.6 Bcf registered on July 24, according to Wood Mackenzie data.

This figure still pales in comparison to overall demand needs. To date in August, natural gas pipeline imports from the United States are averaging 6.2 Bcf/d, according to Wood Mackenzie’s preliminary estimates. NGI data has pipeline imports averaging 6.42 Bcf/d over the past 10 days.

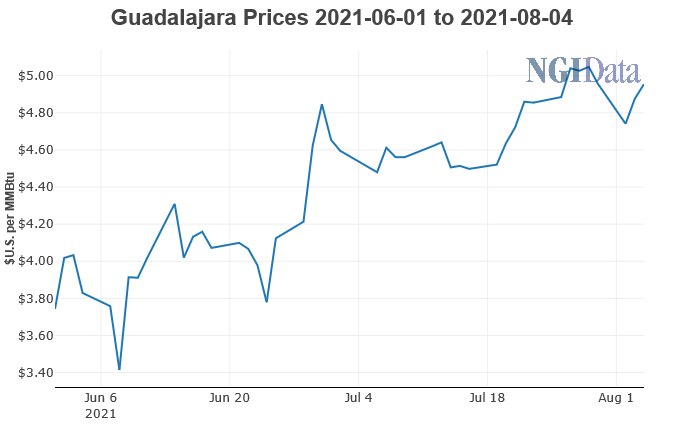

Meanwhile, gas prices in the...