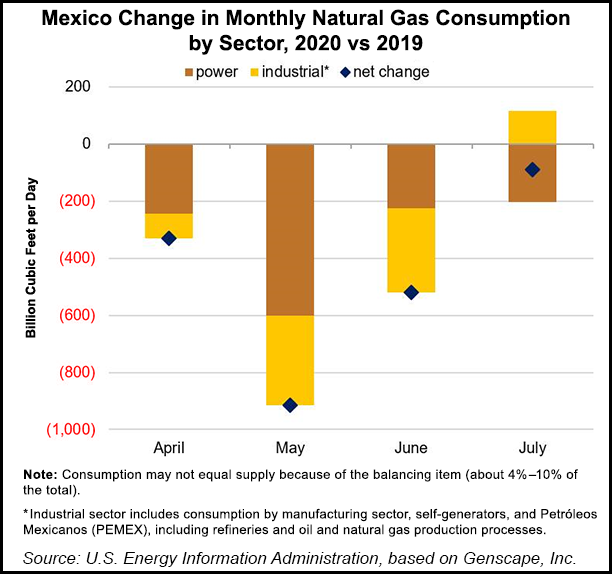

The Covid-19 pandemic dealt a substantial blow to Mexico’s natural gas demand between April and July, according to the U.S. Energy Information Administration (EIA).

Gas consumption in Mexico averaged 8.2 Bcf/d during the period, down 5% or 0.5 Bcf/d from the same span last year, EIA said last Thursday, citing data from Genscape Inc.

The largest reductions occurred in May, when consumption across all sectors averaged 7.8 Bcf/d, down 10% year/year (y/y), researchers said. They noted that natural gas in Mexico is consumed primarily by the power generation and industrial sectors.

Gas-fired power plants accounted for the largest share of the decline in May, with their consumption averaging 14% (0.6 Bcf/d) less than in May 2019.

The countrywide generation load declined by...