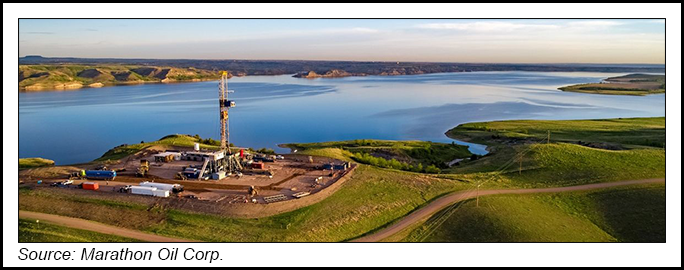

Houston-based Marathon Oil Corp. will stick to its $1 billion capital expenditures (capex) budget in 2021 even if oil prices keep rising, according to management.

Assuming a $60/bbl West Texas Intermediate (WTI) oil price, the independent expects to generate $1.6 billion of free cash flow (FCF) this year, CEO Lee Tillman said during a call to discuss first quarter earnings.

This is up from previous guidance of around $1.5 billion.

Although the assumed oil price is below the current forward curve, Tillman said, “there will be no change to our capital budget even if oil prices continue to strengthen.

“We will simply generate more free cash flow and further solidify our standing as an industry leader when it comes to capital discipline, a hard-earned reputation we have...