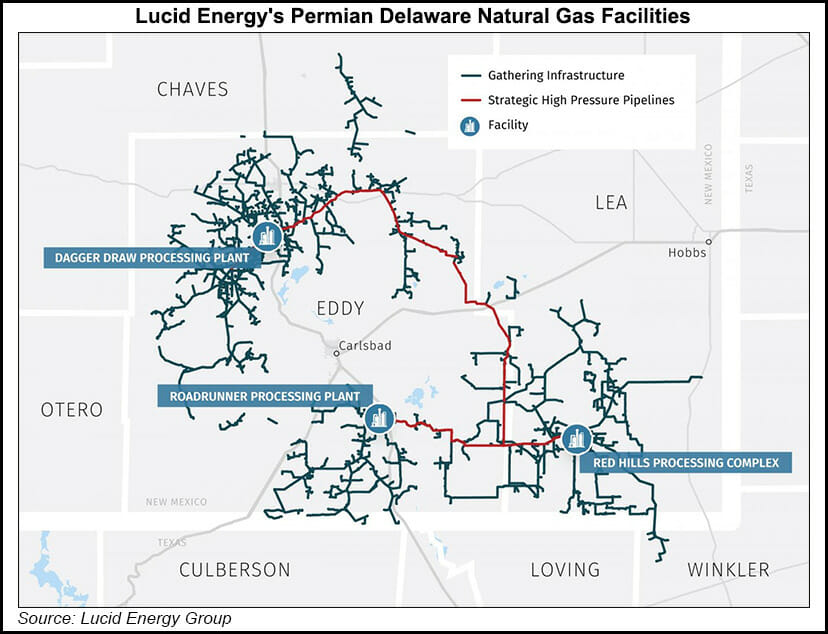

Permian Basin natural gas processor Lucid Energy Group has been given the green light to advance a carbon sequestration project at its Red Hills Complex in Lea County, NM.

Lucid, sponsored by entities of Riverstone Holdings LLC and Goldman Sachs Asset Management, said the Environmental Protection Agency approved its monitoring, reporting and verification (MRV) plan to store carbon dioxide (CO2) from the Delaware sub-basin complex.

Once it gains approval from the Internal Revenue Service to use CO2 sequestration tax credits under Section 45Q, the Dallas-based firm said the carbon capture and sequestration (CCS) project would permanently store emissions in existing and permitted disposal wells.

“Since our entry to the Delaware Basin five years ago, Lucid has targeted...