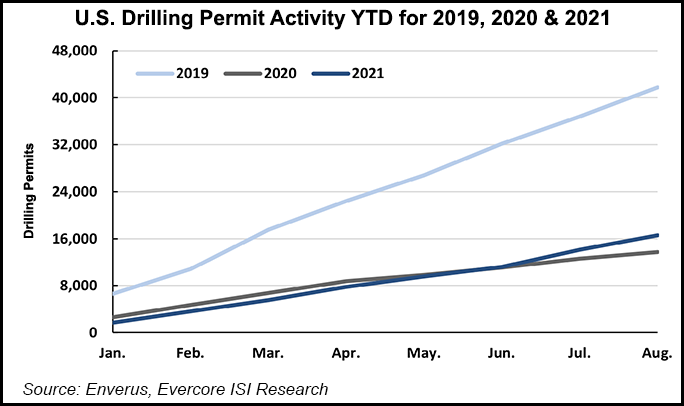

U.S. drilling permit activity slumped across the major Lower 48 basins in August, up sharply from a year ago but down from 2019 levels, according to Evercore ISI.

The Evercore team led by analyst James West compiles a monthly report about drilling activity using state and federal data. Permits are usually requested by producers three to six months before an onshore project is begun.

“After an 81% monthly jump in July, the U.S. drilling permit count slumped 17% in August,” the Evercore analysts noted.

The Permian Basin saw permit activity decline by 28% month/month (m/m), down by 288 permits. Eagle Ford Shale permitting was off 38% from July, down by 107. In the Powder River Basin, permitting fell by 17% m/m, or by 101 permits. Marcellus Shale permitting declined by 30%...