Loose Natural Gas Market Needing More Cold as Futures Slide

Doubts over the durability of late October cold, combined with the prospect of another triple-digit weekly inventory build, saw natural gas futures fail to hang onto early gains Wednesday. After probing as high as $2.384/MMBtu early in the session, the November Nymex contract slid throughout the day to eventually settle at $2.303, off 3.6 cents; December dropped 3.7 cents to $2.495.

In the spot market, cold moving through the Midwest and Northeast this week lifted prices in those regions, while congestion worsened in Western Canada; the NGI Spot Gas National Avg. climbed 11.0 cents to $2.055.

November ran into “some solid technical resistance” at the $2.375-2.380 level early Wednesday, according to Bespoke Weather Services.

Prices “then continued lower as the midday weather models showed less potential for strong, lasting cold,” the forecaster said. “The fundamental state, while marginally tighter the last couple of days, remains very weak, and without cold, easily still supports downside risk to current prices. It is up to cold to support the market.”

The market will need to see a “solidly cold” pattern for late October into early November to sustain a rally, according to Bespoke. That’s still possible, as Wednesday’s data “could simply be a blip” preceding colder trends in subsequent data.

“Our lean is to the colder side into the first week of November, but then turning back milder based on what we see from the tropical forcing patterns,” the forecaster said.

NatGasWeather noted a significant gap in heating demand expectations between the American Global Forecast System and the warmer European model.

“A major pattern change is still expected Oct. 23-25 as stronger cold shots push across the Canadian border and deep into the U.S.,” NatGasWeather said. “This is where major weather model differences continue, with the GFS much colder than the European model with several of the cold shots.

“We expect cold to linger into the first couple days of November, but it could fade shortly after. We expect the onus is on cold proving it and lasting if any sustained weather rally is to be expected.”

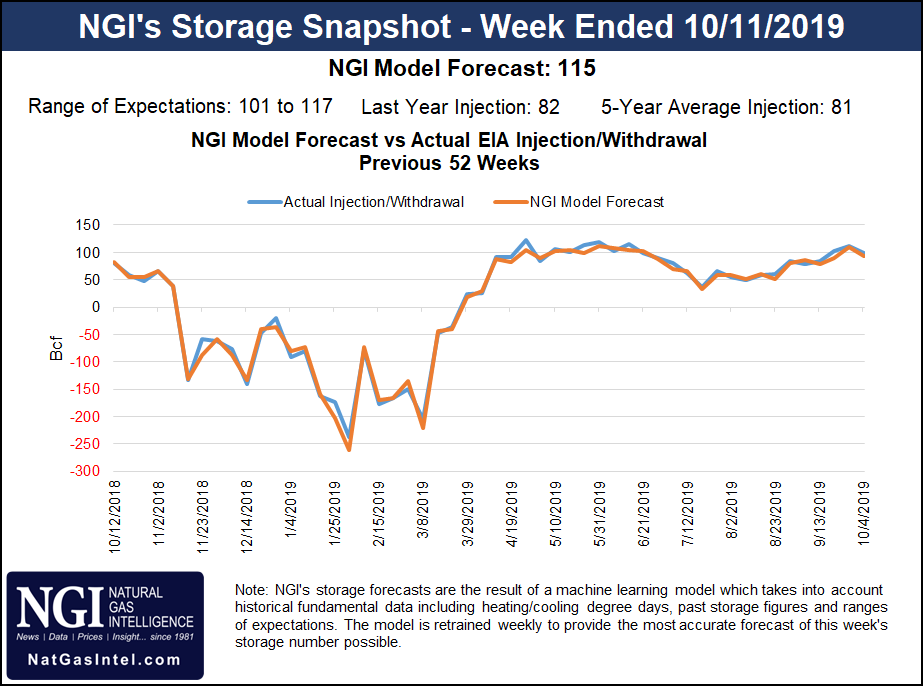

Meanwhile, estimates have been pointing to a triple-digit build from Thursday’s Energy Information Administration (EIA) weekly storage report, which would mark the third 100 Bcf-plus injection in the past four weeks. In keeping with a long-running theme this refill season, an injection in the triple digits would also comfortably top both the year-ago 82 Bcf build and the five-year average 81 Bcf for the week.

A Bloomberg survey produced a median 108 Bcf estimate for this week’s report, which covers the period ended Oct. 11. As of Wednesday, estimates ranged from 101 Bcf up to 117 Bcf.

Intercontinental Exchange EIA Financial Weekly Index futures settled Tuesday at 108 Bcf. NGI’s model predicted an injection of 115 Bcf.

Spot prices strengthened throughout the Midwest and Northeast Wednesday with cooler temperatures moving into those regions. Chicago Citygate added 14.5 cents to average $2.110.

“A weather system with showers and cooling will sweep across the Midwest and Northeast the next few days with lows of 30s to 40s,” NatGasWeather said. “Texas and the southern U.S. will be mostly comfortable but also with areas of showers, with highs of upper 60s to lower 80s, although locally hotter over the Southwest, South Texas and Florida.

“The West will be mostly comfortable besides the cooler Northwest. Overall, decent demand the next few days, then lighter this weekend.”

In the Northeast, Algonquin Citygate tacked on 21.0 cents to average $2.025, while Tenn Zone 6 200L jumped 27.5 cents to $2.195. Further upstream in Appalachia, Texas Eastern M-2, 30 Receipt added 21.5 cents to $1.750.

An update from Texas Eastern Transmission (Tetco) this week has offered more clarity on potentially impactful winter maintenance on the system, Genscape Inc. analyst Josh Garcia said Wednesday.

“Dates were finally set for the Pipeline Integrity Program tool runs and report dates for all of the segments between Delmont to Perulack Line 12, the event that will cause the roughly 770 MMcf/d constraint on the Northern Penn-Jersey Line and has caused the volatility in futures markets,” Garcia said. “Specifically, tool runs and estimated report dates have been set for Oct. 30 and Dec. 5, respectively, for Delmont to Armagh Line 12 Section 1 and Nov. 3 and Dec. 8 for Section 2.”

This could offer an indication of when to expect these segments to return to service, according to the analyst.

“We believe that the soonest that segments will be returned to service is after tool runs revalidate previous tests and return with positive results, in this case, Dec. 8,” Garcia said. “This confirms the market’s bullish sentiment for M3 November and December prices, as flows have historically reached above the maintenance operating capacity of 2.16 Bcf/d by mid-November. More upside risks exist if negative results are found.”

December Texas Eastern M-3 forwards have risen sharply since late August, correlating with the release of new information on Tetco’s efforts to ensure the integrity of its system in the wake of an Aug. 1 explosion in Kentucky. Texas Eastern M-3 basis traded at $1.925 Tuesday, compared to just 60.4 cents on Aug. 30. The risk premium has spread to the January contract as well, with basis climbing to $4.345 Tuesday, up from $2.906 on Aug. 30, NGI’s Forward Look data show.

Meanwhile, after pipeline congestion helped sink Westcoast Station 2 prices into the negatives Tuesday, conditions worsened for sellers at the Western Canada hub in Wednesday’s trading. Prices there fell another C69.5 cents to average minus C97.5 cents/GJ.

This came as Westcoast Energy Inc. notified shippers of mandatory account balancing due to high linepack on the Enbridge BC Pipeline and expectations that the line would “pack substantially” during Wednesday’s gas day.

“With current linepack conditions, Enbridge BC Pipeline will not be able to absorb the forecasted pack…and requires account recovery of 150,000 GJ (draft),” the operator said. “Shippers must ensure accounts are within tolerance to avoid potential business cuts or swing gas costs.”

Back on the U.S. side of the border, Northwest Sumas moderated Wednesday, though prices there continued to trade at a premium to surrounding hubs as daily north-to-south flows through Westcoast’s Station 4B South remain restricted at around 1.2 million GJ. Northwest Sumas skidded 47.0 cents to average $3.510.

Farther south in California, prices were mixed. Malin climbed 21.5 cents to $2.075. Southern California prices showed few signs of being impacted by a maintenance-related restriction on the El Paso Natural Gas (EPNG) system. SoCal Border Avg. dropped 16.5 cents to $2.460.

Maintenance Thursday could disrupt about 100 MMcf/d of southbound flows on EPNG’s Havasu Crossover in western Arizona, according to Genscape analyst Joe Bernardi.

Bernardi said flows through this area are reflected in the volumes reported at the Dutch Flats station on this line, which connects EPNG’s North and South mainlines. The line is bidirectional but almost always flows north-to-south near full capacity, according to the analyst.

“This maintenance will see operational capacity drop to 509 MMcf/d compared to the base capacity of 617 MMcf/d, so the same roughly 110 MMcf/d impact is expected for flows,” Bernardi said. “This meter has also been subject to other planned maintenance that started earlier this week, reducing operating capacity to a less-restrictive 551 MMcf/d on Tuesday and to 581 MMcf/d” for Wednesday.

“Past maintenance events here have corresponded with upward movements in SoCal Border basis price, although usually only when the capacity reductions are more severe than this one.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |