U.S. independent Hess Corp. expects production from its Bakken Shale assets to grow 6-9% in 2022 to 165,000-170,000 boe/d.

The New York-based producer is ramping up Bakken activity after adding a third rig last September. Previously it had slashed its rig count from six to one because of the coronavirus pandemic. A fourth rig could potentially come online next year, executives said in an earnings call Wednesday.

Bakken net production was 159,000 boe/d in the fourth quarter compared with 189,000 boe/d in the prior-year quarter, primarily due to the impact of lower drilling activity.

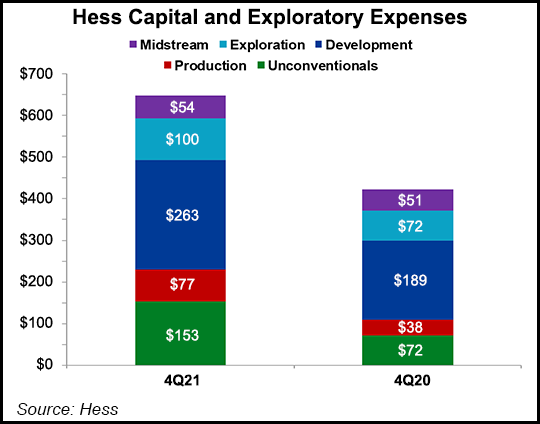

The company can generate “attractive returns” in the Bakken at $60/bbl for West Texas Intermediate (WTI) oil, executives said. They called the Bakken a “cash engine.” In 2022, Hess will...