Natural Gas Prices | E&P | Markets | NGI All News Access | Oil

Henry Hub to Rebound, Oil to Move Higher in 2021, EIA Says

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |

Markets

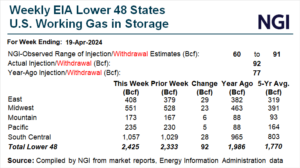

Natural gas futures tried to shake off a stronger-than-expected government inventory print Thursday but settled lower as benign weather and LNG hiccups weighed. At A Glance: EIA reports 92 Bcf injection West Texas cash flips negative Freeport LNG stays down Following a nearly 16-cent decline, the May Nymex contract settled down 1.5 cents day/day at…

April 25, 2024By submitting my information, I agree to the Privacy Policy, Terms of Service and to receive offers and promotions from NGI.