E&P | NGI All News Access | NGI The Weekly Gas Market Report

Finance Ministry Can’t Save Pemex, Warns Former Mexico Oil Official

The financial health of Mexican state oil company Petróleos Mexicanos (Pemex) remains “the most critical situation” facing the country’s energy sector, according to former Comisión Nacional de Hidrocarburos (CNH) chairman Juan Carlos Zepeda.

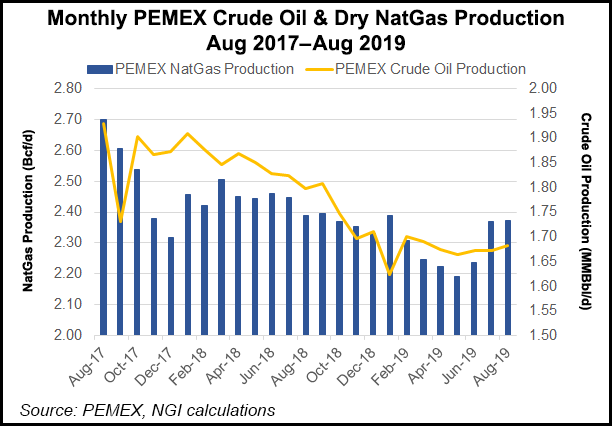

Pemex’s net debt stood at 1.96 trillion pesos, or about $102 billion at the current exchange rate, as of June 30. Meanwhile, its crude oil production has fallen by more than half since peaking at 3.4 million b/d in 2004.

“We can’t expect to solve the problem by taking from the Finance Ministry; it would be like wanting to improve our personal finances by passing money from one pocket to the other,” Zepeda wrote in a new report published by the Centro de Investigación y Docencia Económicas (CIDE).

CNH regulates the upstream segment of Mexico’s oil and gas industry.

As part of a plan to “rescue” the heavily indebted Pemex, President Andrés Manuel López Obrador’s government has pledged some $23.5 billion of support from 2019-2023 in the form of capital injections, tax breaks, prepayment of debt, and support in the fight against fuel theft from its vast pipeline network, according to local think tank Instituto Mexicano para la Competitividad (IMCO).

However, the rescue package fails to address the root causes of Pemex’s problems, according to Zepeda.

“To stop the fall in production and reserves, Pemex requires additional annual investment of $17 billion,” Zepeda said. “In 2019, despite the fact that the executive branch and congress made a great effort to increase investment in the [company], its exploration and production budget is only $10 billion.”

He added that private investment in Pemex “is absolutely necessary.”

Zepeda reiterated his past calls for Pemex to follow the “Chinese model,” a reference to PetroChina Company Limited, the publicly traded arm of state-owned China National Petroleum Corporation.

The idea, he said, would be for Pemex to create an exploration and production (E&P) subsidiary, and to assign it a diverse portfolio of upstream assets.

“This subsidiary, free of liabilities and with a set of highly productive assets, could in a few months raise capital in the stock market,” Zepeda said. “Pemex would retain the majority of shares in the subsidiary, and total control of it.”

He added that, “it is necessary also to reactivate Pemex’s farmout program,” referring to tenders for operating stakes in select upstream Pemex areas.

The CIDE report focused mainly on the importance of Mexico’s regulatory agencies, including CNH and the Comisión Reguladora de EnergÃa (CRE), maintaining their independence and not becoming politicized.

Zepeda — who stepped down from his post last December, five months before his term was set to end — said that autonomy should not be a goal in and of itself, but rather a means to ensure accountability, transparency, and professionalism from regulators.

“The use of autonomy in the energy sector in Mexico responds fundamentally to the need for professionalization of public servants; technical professionals who are not forced to leave their posts for political reasons when the presidential term ends.”

At the time of his resignation, Zepeda denied reports that he was pressured to step down by the López Obrador government, which assumed power the same month.

Zepeda’s counterpart at the CRE, Guillermo GarcÃa Alcocer, resigned in June 2019, two years before his term was set to end, following public clashes with López Obrador.

In his resignation letter, GarcÃa Alcocer said that the CRE now had a vision that was different from his own.

The senate this month confirmed the appointment of Leopoldo Vicente Melchi, a veteran of Pemex and energy ministry Sener, to fill the vacancy left by GarcÃa Alcocer.

López Obrador this week submitted a shortlist of candidates to replace Zepeda at CNH.

The AsocIación Mexicana de Empresas de Hidrocarburos (Amexhi), the country’s main oil and gas trade group, appeared to question the suitability of the candidates in a statement published on Wednesday.

“In relation to the shortlist proposed by President Andrés Manuel López Obrador to fill the vacancy of CNH chairman, AMEXHI respectfully asks the senate, in the election of such an important position, to contemplate … the spirit of the coordinated energy regulators law, which seeks to promote the efficient development of the energy sector, for which it is fundamental to objectively analyze the technical capacities of the candidates.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 |