Natural Gas Prices | Markets | NGI All News Access | Shale Daily

February Natural Gas Ends Up in First Day as Lead on Cold Weather, Bullish Storage

February Nymex natural gas futures closed the first day as the front-month contract up 12.0 cents, adding to early gains after the U.S. Energy Information Administration (EIA) reported a storage withdrawal that surprised the market to the upside.

At A Glance:

- February contract ends 12 cents higher

- EIA reports 87-Bcf bullish draw

- Cash sinks with weekend inclusion

The contract settled Thursday’s regular trading session at $2.557/MMBtu, above the intraday low of $2.412 and below the session’s $2.576 high.

Cold weather outlooks pulled futures up early in the session and supported mixed activity in the spot gas market for natural gas traded for Friday, Dec. 29 through Sunday, Dec. 31, flow to accommodate business closures for the New Year’s holiday.

NGI’s Spot Gas National Avg. was down 7.0 cents at $2.170 with the weekend inclusion.

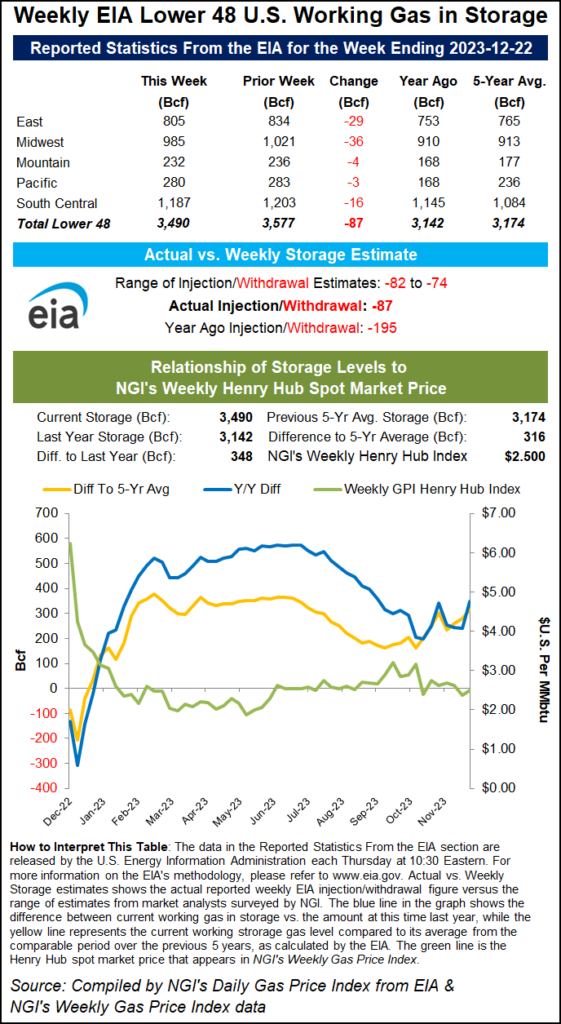

The February futures contract was further boosted at 10:30 a.m. ET after the EIA reported an 87 Bcf withdrawal from Lower 48 natural gas stocks for the week of Dec. 22 that was above most industry estimates.

NGI modeled a 76 Bcf withdrawal ahead of the print. Reuters’ poll produced a median withdrawal prediction of 79 Bcf. A Wall Street Journal survey ranged from withdrawals of 72 Bcf to 82 Bcf, averaging 78 Bcf.

“Bullish!” said one participant on the online energy platform Enelyst.

However, the pull was well below the hefty year-earlier draw of 195 Bcf — when winter storms led to freeze-offs amid huge demand spikes — and the five-year average 123 Bcf withdrawal for the week.

The total working gas supply stood at 3,490 Bcf, a still healthy 348 Bcf above the year-ago level and 316 Bcf above the five-year average.

This was the second consecutive 87-Bcf storage withdrawal reported by the EIA.

Gelber & Associates analysts noted that while temperatures were slightly milder and heating demand was lower week-over-week, power burn and LNG exports were higher, and Lower 48 production declined modestly.

NatGasWeather said surpluses could increase to more than 375 Bcf, with the next several reports expected to print “decently lighter than normal.”

The firm said weather was warmer than normal over most of the country this past week, the Christmas through New Year’s Holiday tends to bring lighter demand, and warmer weather is forecast for much of the next 10 days.

Early estimates from Reuters for the week ending Dec. 29 ranged from withdrawals of 76 Bcf to 12 Bcf, with an average decrease of 56 Bcf.

That compares with a withdrawal of 219 Bcf during the same week last year and a five-year average decrease of 97 Bcf.

“It will then be up to colder/bluer weather maps arriving in January to prevent surpluses from increasing further,” NatGasWeather said.

Will Cold Arrive?

At midday, the American weather model trended warmer than the overnight outlook, especially for what was expected to be the coldest shot of the coming series for Jan. 5-7, NatGasWeather said.

The meteorologists said this period is now not nearly as cold as it had shown a couple of days ago.

But what might have held up prices is overnight data “teasing a frosty set up” over the country from Jan. 11-13, said the firm, while warning “that’s quite far out in time” and could trend warmer, “just as Jan. 1-8 did the past few days.”

Natural gas futures could find additional support should colder winter weather outlooks hold up.

But the Gelber analysts said given healthy storage and the oversupply reflected in fundamentals, “we continue to expect downside and see new lows as a distinct possibility.”

Possible Price Volatility

The Gelber team said the healthy storage levels would likely tamp down price volatility, as gas can quickly be deployed in response to sudden increases in demand driven by weather events.

Yet, price volatility could be elevated by liquefied natural gas exports and the addition of renewables into the energy mix that could contribute to “more week-over-week irregularity for gas demand in the future,” the firm said.

Wood Mackenzie data showed LNG nominations at 13.9 Bcf/d Thursday, a notch below 14.0 Bcf/d Wednesday.

Offsetting demand support, Lower 48 natural gas production at 105.2 Bcf/d Thursday was slightly below Wednesday and still near record high levels.

Cash Markets

Midwest, Appalachia and Northeast regional spot gas averages were slightly higher against a broader market downtrend, as cold weather through Sunday propped prices up at locations scattered across the regions.

The Northeast Regional Avg. was 14.0 cents higher day/day at $2.200. Gains at hubs across Appalachia brought the Appalachia Regional Avg. 8.5 cents higher to $1.740, while the Midwest Regional Avg. was unchanged at $2.100.

Conversely, in West Texas, Waha sank 70.0 cents to $1.420, and El Paso Permian fell 60.5 cents to $1.500, reflecting both milder weather and the weekend days included in the trading package.

North American natural gas traded on Friday, Dec. 29 is for delivery from Monday, Jan. 1 through Tuesday, Jan. 2. NGI’s Daily Gas Price Index will not be published on Monday, Jan. 1.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 2158-8023 |