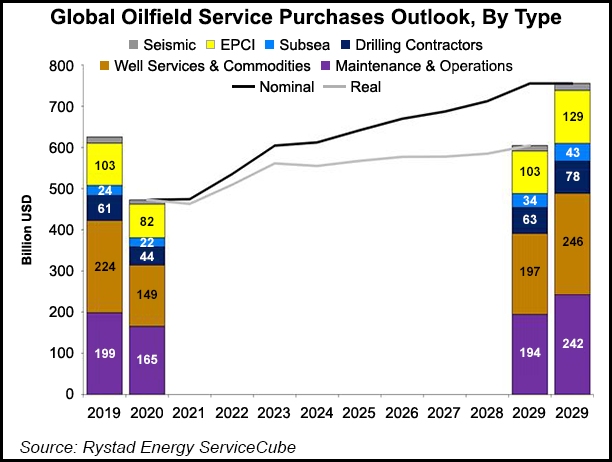

The oilfield services (OFS) market could lose as much as $340 billion total for the value of purchases over the next eight years, particularly in unconventional plays, as oil and gas investments decline and consumption slows, according to Rystad Energy.

Researchers now expect peak oil demand to “arrive earlier and at a lower level than previously thought,” which may lead to reduced spending by exploration and production (E&P) companies.

Covid-19’s impact on the energy market, along with the accelerating energy transition, led Rystad in November to revise its peak oil demand forecast.

Peak oil now is expected in 2028 with production topping out at 102 million b/d. Rystad’s previous forecast put peak demand arriving in 2030 with output averaging 106 million...