Shale Daily | E&P | Infrastructure | NGI All News Access

Energy Spectrum, PEs Hunting for North American Midstream Investments

Plummeting demand in the wake of coronavirus fallout is punishing oil and gas prices, forcing drillers to shut in wells and curtail capital expenditures (capex). Midstream operators are feeling the squeeze as well, cutting spending and delaying projects, and private equity (PE) is stepping into the void.

Energy Spectrum Capital is forging ahead with plans to invest in North America’s midstream sector. The Dallas-based firm this month closed its eighth fund, Energy Spectrum Partners VIII, with $969 million committed to four portfolio companies and a fifth in documentation.

Founding partner James Benson said the new capital provides “a renewed mandate to support best-in-class management teams to build successful midstream companies.” Despite the extraordinary environment, the firm intends to “profitably navigate the market volatility and build another strong portfolio.”

Three of the four companies in which the new fund has invested are led by management teams with whom Energy Spectrum has previously partnered, Benson said. Founded in 1995, it closed its seventh namesake investment vehicle for $1 billion in 2014.

The latest fund received commitments from 82 limited partners, including pension funds, insurance companies and endowments. It plans to identify investments in oil and natural gas gathering and transportation systems, processing and treating plants, and storage facilities. Energy Spectrum focuses on lower middle market companies that acquire, develop and operate North American midstream assets.

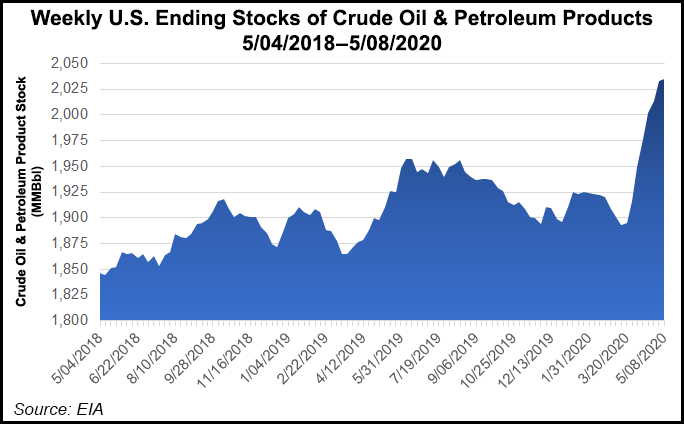

President Thomas Whitener Jr. said the fund’s managers intend to “take advantage of opportunities amid the significant price dislocations in the current market.” The potential for acquisitions could ripen in the midstream space, as revenue-strapped companies are under increasing pressure to sell off assets and pay down debt. Demand for infrastructure to address oil and gas storage needs also presents opportunities.

Other financial firms are also pushing forward in the midstream arena.

Houston-based Moda Midstream LLC, for example, in April placed into service the final 495,000 bbl tank from its 10 million bbl crude oil expansions at the Moda Ingleside Energy Center and Moda Taft Terminal, both in South Texas. It also said it had started building an expansion at the Ingleside site to add 3.5 million bbl of crude storage. The work is backed by PE energy giant EnCap Flatrock Midstream, based in San Antonio, TX.

Another case in point is a fund managed by Boston-based PE firm Arclight Capital Partners LLC, another big energy-focused PE firm, which is backing Camelback Midstream Holdings LLC along with its management team. Scottsdale, AZ-based Camelback secured a $400 million capital commitment to acquire and develop midstream infrastructure.

“We look forward to supporting the Camelback Midstream team as they pursue opportunities in what we believe will be a compelling acquisition environment for well capitalized midstream companies,” ArcLight founder Dan Revers said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |