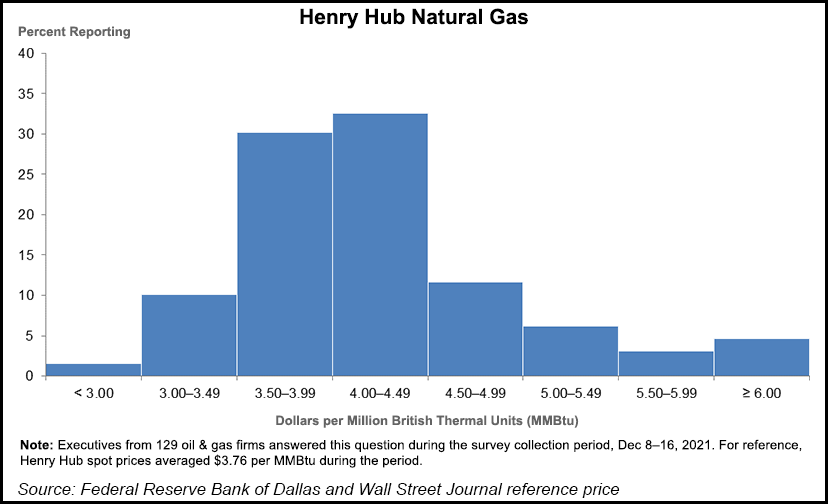

Executives in the energy breadbasket of the country are forecasting Henry Hub natural gas prices to average $4.06/MMBtu at the end of 2022, according to the latest quarterly survey by the Federal Reserve Bank of Dallas.

The Dallas Fed, as it is known, every three months surveys exploration and production (E&P) companies and oilfield services (OFS) firms headquartered in the Eleventh District, which encompasses Texas, Northern Louisiana and southern New Mexico. For the latest survey, 134 executives responded, including 90 E&Ps and 44 OFS firms.

The survey, conducted Dec. 8-16, queried executives about capital expenditures (capex) plans and commodity prices, among other things. They also were asked for their outlook on prices for goods and services. Overall, the region’s oil...