NGI Data | Markets | NGI All News Access

EIA Reports 115 Bcf Storage Build, Drops Mic on Natural Gas Futures

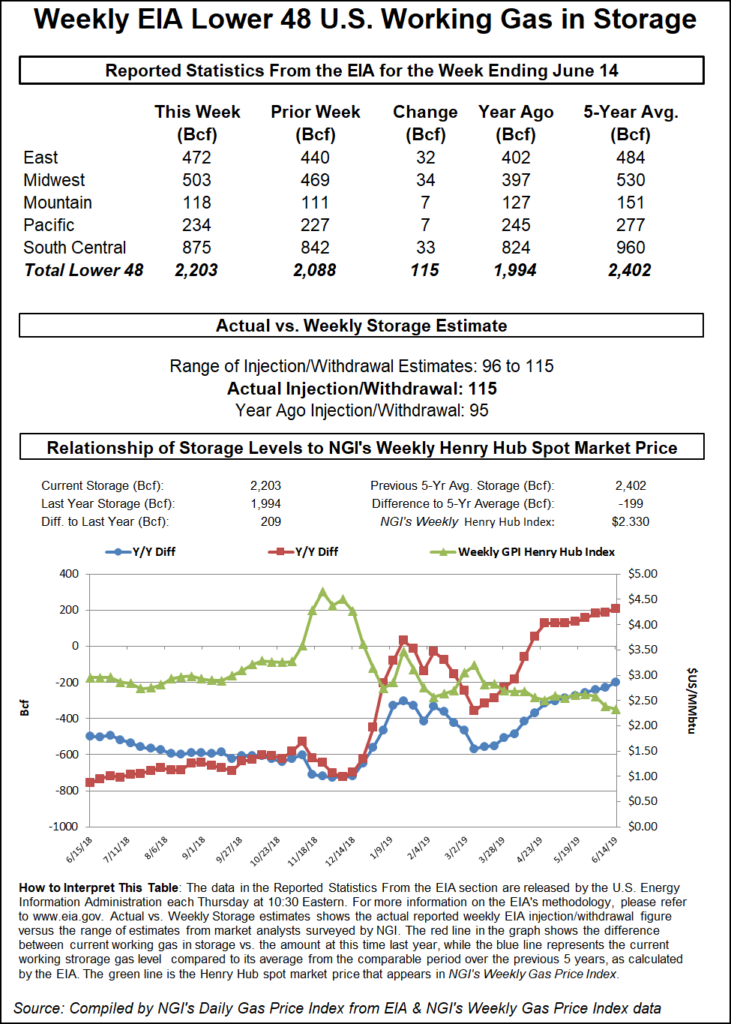

The Energy Information Administration (EIA) dropped another bombshell on the natural gas market, reporting a 115 Bcf injection into storage inventories for the week ending June 14.

The reported build compares with last year’s 95 Bcf injection and the 84 Bcf five-year average build.

The 115 Bcf boost to storage was once again a shock to the market, as most estimates had clustered around a build roughly 10 Bcf below the actual print. Nymex futures responded immediately to the bearish EIA data, falling 5 cents at the front of the curve. The July contract was trading about 2 cents higher day/day near $2.30 a few minutes before the report was released at 10:30 a.m. ET.

Prices dropped down to $2.246 after the print hit the screen, and by 10.50 a.m., had fallen to $2.211, down 6.5 cents from Wednesday’s settle. August and September were down around 8 cents to $2.184 and $2.164, respectively.

“That was a big crusher,” said Huntsville Utilities’ Donnie Sharp, senior natural gas supply coordinator, on energy chat room Enelyst. “Lots of volumes reversing course very quickly.”

Ahead of the report, a Bloomberg survey of 14 market participants showed an injection range between 96 Bcf and 113 Bcf, and a median of 105 Bcf. A Reuters survey ranged from a 96 Bcf build to a 115 Bcf build, with a median of 105 Bcf. NGI also projected a 105 Bcf injection.

“Summer’s over. We’ll see you next winter,” said independent weather forecaster Corey Lefkov.

Indeed, the natural gas market has remained unconvinced over the timing and intensity of heat expected later this month, and the mild weather so far this summer has led to a string of triple-digit storage injections. Thursday’s report was the seventh such 100 Bcf-plus build in a row.

“Balance wise, it is back looser, and rather difficult to justify based on the best data we have available to us,” Bespoke Weather Services said. “There appears to be, quite simply, much more supply out there than is indicated by the data, giving us very low confidence in what to expect going forward in terms of the supply/demand balance.”

Broken down by region, 34 Bcf was injected in the Midwest, 32 Bcf was added in the East and 33 was stocked in the South Central, including 26 Bcf into nonsalt facilities and 8 Bcf into salts, according to EIA. At 2,203 Bcf, inventories are 209 Bcf above last year’s levels and 199 Bcf below the five-year average.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |