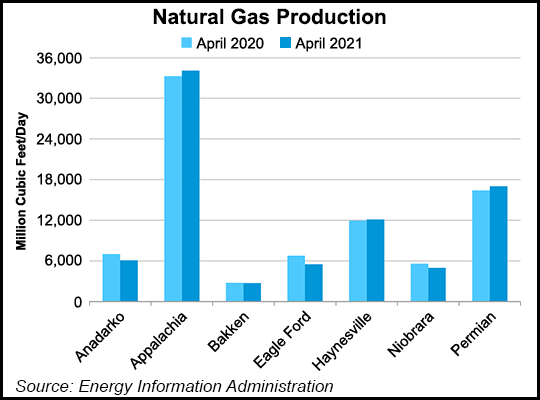

Natural gas production from seven key U.S. regions is set to fall by 316 MMcf/d from March to April, extending a downward trajectory in projected output from the domestic plays that goes back to early last year, according to new data published Monday by the U.S. Energy Information Administration (EIA).

Combined output from the Anadarko, Appalachian and Permian basins, as well as from the Bakken, Eagle Ford, Haynesville and Niobrara formations, is set to fall from around 82.9 Bcf/d in March to slightly under 82.6 Bcf/d in April, EIA said in its latest Drilling Productivity Report (DPR).

Broken down by region, month/month declines are expected from the Anadarko (down 126 MMcf/d), Appalachia (down 149 MMcf/d), the Bakken (down 44 MMcf/d), the Eagle Ford (down 65,000 MMcf/d) and...