Markets | NGI All News Access | NGI The Weekly Gas Market Report

EIA Lowers ’19 Henry Hub Forecast to $2.83; Polar Vortex Gas Demand Near Record

Strong growth in domestic natural gas production is expected to keep downward pressure on prices in 2019, according to the Energy Information Administration (EIA), which has lowered its forecast for Henry Hub prices.

In the latest edition of its Short-Term Energy Outlook (STEO), EIA said it expects Henry Hub prices to average $2.83/MMBtu in 2019, down 32 cents from the 2018 average of $3.15/MMBtu and 6 cents below last month’s forecast of $2.89/MMBtu.

New York Mercantile Exchange contract values for May 2019 delivery traded during the five-day period ending Feb. 7 suggest a range of $2.15 to $3.30/MMBtu, encompassing the market expectation of Henry Hub prices in May at a 95% confidence level, EIA said.

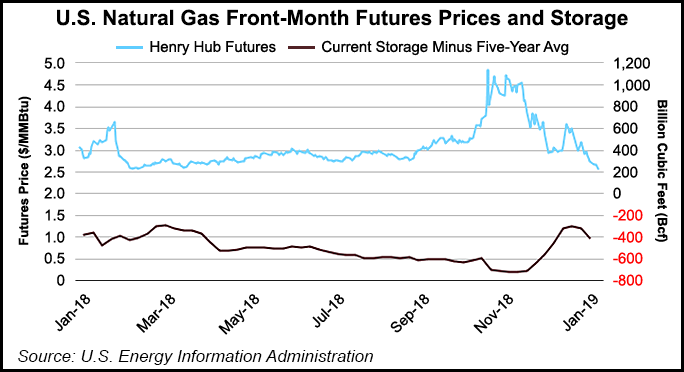

“Despite a cold snap in late January, average temperatures for the month were milder than normal in much of the country, which contributed to lower prices,” EIA said. Henry Hub averaged $3.13/MMBtu in January, down 91 cents from December. The front-month natural gas futures contract price for delivery at the Henry Hub settled at $2.55/MMBtu on Feb. 7, a 41-cent decrease from Jan. 2.

“Temperatures were much warmer than normal across the Lower 48 states for the first three weeks of January, resulting in lower-than-normal heating degree days [HDD] and withdrawals from natural gas storage…A polar vortex during the last few days of January in the Midwest and Northeast significantly increased HDD and natural gas demand in residential and commercial sectors,” EIA said.

An estimate by PointLogic Energy determined that Jan. 30 was the second-highest date on record for U.S. gas consumption in the residential and commercial sectors, EIA noted.

“The colder weather prompted higher-than-normal withdrawals from natural gas underground storage at the end of January. This change contributed to a sharp, but relatively brief, increase in natural gas futures prices in the second half of January. By the first week of February, prices had returned to levels last seen in February 2018.”

According to EIA, the gas inventory deficit to the five-year (2014–2018) average narrowed to 305 Bcf on Jan. 18 from 560 Bcf on Dec. 28, 2018.

“Front-month natural gas futures prices during this period of production growth have not experienced a decline with increased production, as occurred in 2014 and 2015, most likely because of lower-than-average inventory levels,” EIA said. “Higher domestic and international demand helped to keep inventories well below the five-year average for the past year.”

Total U.S. dry gas production reached an estimated 87 Bcf/d in January, 9.4 Bcf/d higher than year-ago levels. The agency said it expects dry production will average 90.2 Bcf/d in 2019, up 6.9 Bcf/d from 2018. Dry gas production is expected to continue to rise in 2020 to an average of 92.1 Bcf/d.

EIA said it expects gas to account for 36% of power generation in 2019 and 37% in 2020, up from 35% in 2018.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |