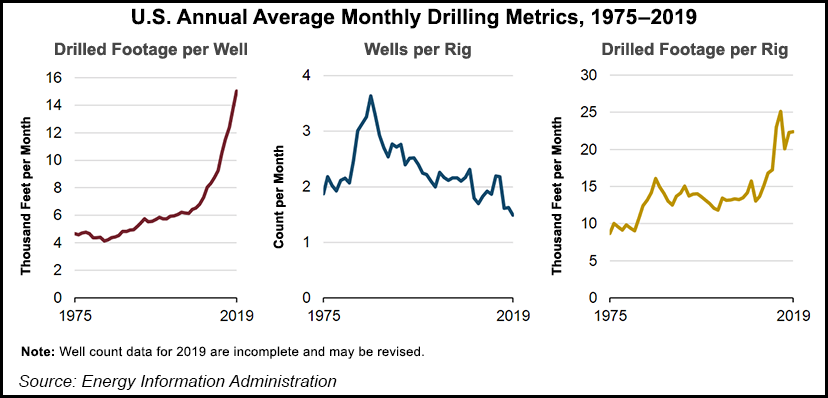

EIA Cites Dramatic Improvements in U.S. Onshore Drilling Efficiency Amid Record 2019 Oil, Natural Gas Output

Surging U.S. crude oil and natural gas production over the last decade or so has been accompanied by dramatic improvements in onshore drilling efficiency, the Energy Information Administration (EIA) said Thursday.

Oil and gas output each hit all-time highs in 2019, even as the average monthly rig count and number of wells drilled per month were among the lowest in the last 45 years, said EIA researchers led by April Patel and Emily Geary.

The United States produced 12.2 million b/d of crude and 111.5 Bcf/d of natural gas in 2019, EIA data show.

Citing preliminary data from Baker Hughes Co. and IHS Markit, the EIA analysts said that the average rig count per month in 2019 was 943, with an average of 1,400 wells drilled per month.

“One factor that has contributed to the increase in production has been the ability to contact more of the formation using horizontal drilling,” researchers said. “The average footage drilled per well was 15,000 feet/well in 2019, reflecting longer horizontal well lengths.”

The number of oil and gas wells drilled per month, per rig, averaged 1.5 in 2019, down from 3.6 in 1986, the EIA team said, highlighting the dramatic increase in horizontal well length.

Horizontal wells averaged 18,000 feet of lateral length in 2019, up from about 10,000 feet in the early 2000s, researchers said, adding that horizontal wells’ share of total wells drilled rose to 75% in 2019 from 2% in 1990.

Another important factor in the efficiency gains is that horizontal wells have more wellbore, i.e. the hole that forms the well, in contact with the producing formation, “increasing the amount of crude oil or natural gas that can be recovered compared with a vertical well,” researchers said.

Lower 48 operators have struggled, however, to translate the efficiency gains into positive cash flow, a challenge that has intensified in the age of Covid-19.

New research by Deloitte suggests the unconventional segment may be facing asset writedowns of up to $300 billion, “with significant impairments” in 2Q2020, “potentially setting off a chain reaction of insolvencies and restructuring.”

Although U.S. operators are starting to bring some curtailed production back online as oil prices recover, oil and gas production from seven of the country’s most prolific onshore unconventional plays is expected to decline for a third straight month in July, according to EIA’s most recent Drilling Productivity Report.

2019 is likely to be the last year for a while that the U.S. breaks any production records, as the International Agency is projecting U.S. oil output to fall by 900,000 b/d in 2020 and another 300,000 b/d in 2021, “unless higher prices unlock fresh investments in the shale patch.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |