Dominion Energy isn’t throwing out the old (fossil fuels generation) for the new (zero-carbon investments) but the executive team is mounting what may be the industry’s largest regulated decarbonization investment ever.

Executive Chairman Tom Farrell, CEO Bob Blue and CFO Jim Chapman shared a microphone earlier this month to discuss fourth quarter and full-year 2020 results. As important, they laid out their goals for the five-state utility as it segues to a green future.

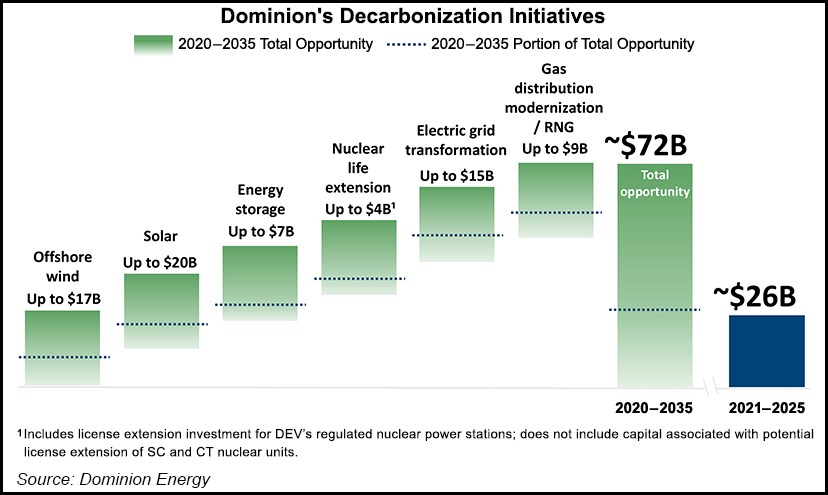

Over the next 15 years, Dominion expects to invest about $70 billion in “green capital,” Blue said. At the same time, the goal is to reduce emissions while maintaining competitive customer rates.

“We don’t believe any other company in the United States offers the duration, visibility and scope of...