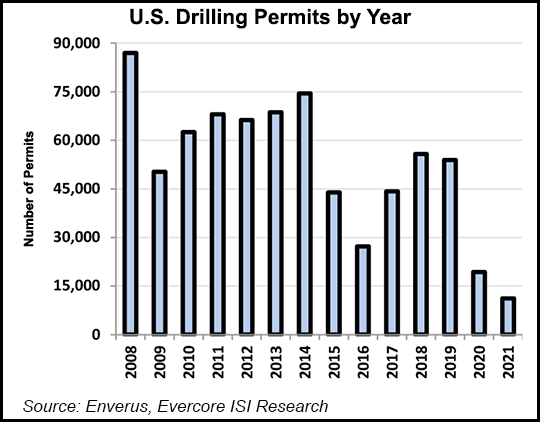

U.S. oil and gas drilling permitting has risen sharply from a year ago, but the gains are uneven, with the Denver-Julesburg (DJ) and Powder River basins drying up, while Haynesville Shale activity has increased, according to data compiled by Evercore ISI.

The domestic permit count climbed by 32% in June from a year earlier, and it was up 1% on a year-to-date basis, state and federal permitting data indicate. Still, permitting in May skidded by 23% month/month (m/m), and it was down another 6% in June, analyst James West and his team said in a note Tuesday.

“For context, the year-to-date U.S. drilling permit count is now off 65% versus 2019 levels,” West said.

Analysts each month compile the permitting numbers using state and federal data.

Year-to-date, DJ permitting...