NGI Data | Markets | NGI All News Access

December NatGas Falls Again Ahead of Predicted Storage Withdrawal; Cash Unchanged

Natural gas futures fell for the second consecutive day Tuesday, threatening to fill the bottom of a gap in the chart that formed earlier this month. With the Thanksgiving holiday approaching, spot prices were mixed, and save for some larger shifts in the Northeast and in the West, changes mostly fell within a nickel of even. The NGI National Spot Gas Average finished flat at $2.91.

The December contract settled 3 cents lower Tuesday at $3.017, trading as high as $3.064 before falling amid some short-term warming in the weather outlook. January also settled 3 cents lower at $3.110.

Powerhouse CEO Al Levine said he’s looking at the $2.998 level — the bottom of a gap that formed with the weather-driven surge in prices earlier this month — as a potential pivot point.

“It looks to me with Tuesday’s low we’ve almost filled that gap,” he told NGI. “To my mind, this is an important number, because once that closes, should it close — and it should — then the question becomes, does that become a buy indicator? I’m not saying it does, but one could see the possibility that once that gap is filled, the market recovers and moves higher.”

Bespoke Weather Services attributed some improvement in the December contract earlier in the day to “bullish long-range risks we saw on overnight weather model guidance, though prices pulled back through the afternoon as the afternoon” data “did not show the same risks that the overnight suite had. The result is that medium-term gas-weighted degree day losses have opened up a bit more short-term downside for natural gas prices than we had expected” earlier Tuesday.

“Current forecasts do appear warm enough for potentially one more short-term leg lower,” testing $2.98 or possibly $2.92-2.93, “before we see prices collecting on support and recovering once modeling guidance finally picks up on December colder risks.”

Meanwhile, expectations for the Energy Information Administration’s (EIA) storage inventory report, set to arrive a day early at noon on Wednesday because of the holiday, indicate another withdrawal is on tap.

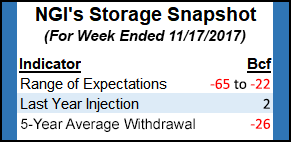

The average taken from a Reuters survey of 23 traders and analysts showed a 51 Bcf withdrawal for the week ended Nov. 17, which would follow the 18 Bcf withdrawal reported the previous week. Responses to the Reuters survey ranged from -63 Bcf to -22 Bcf. Last year, 2 Bcf was injected, and the five-year average stands at -26 Bcf.

Stephen Smith Energy Associates, in its preliminary estimate, is calling for a withdrawal of 48 Bcf.

“Working storage is projected to decrease from 3,772 Bcf to 3,724 Bcf,” Smith analysts wrote. “This week’s projected draw of 48 Bcf compares with a seasonally normal weekly draw of 48 Bcf” based on 2006-2010 norms. “This difference yields a storage surplus increase of 0-1 Bcf, from a prior-weeks surplus of 147 Bcf, to a projected Nov. 17 surplus of 148 Bcf (versus a year-ago surplus of 466 Bcf).”

ION Energy’s Kyle Cooper is calling for a 51 Bcf withdrawal, while PointLogic Energy is forecasting a net 54 Bcf decline in inventories.

Forecasts for cooler temperatures across the Northeast helped lift regional spot prices Tuesday. PointLogic Energy is forecasting total Lower 48 demand to jump to 76.4 Bcf/d Wednesday from 70.2 Bcf/d Tuesday.

“Of this 6 Bcf/d increase, nearly 5 Bcf/d is due to residential/commercial demand, as the cold snap we have been anticipating finally arrives,” PointLogic analyst Rishi Iyengar wrote in a note to clients. “The Northeast and the Midcontinent are expected to account for the majority of the additional heating load, but temperatures across all of our regions are forecast to decrease, with the exception of the western region.

“In the West, temperatures are expected to increase into cooling degree day (CDD) territory…and so power demand is expected to see a 0.7 Bcf/d bump.”

MDA Weather Services is forecasting below-normal temperatures to kick off on Thanksgiving Day and Friday in Boston, New York, Philadelphia and Washington, DC.

Algonquin Citygate added 19 cents to $3.25 Tuesday, while Tennessee Zone 6 200L jumped 18 cents to $3.41. Transco Zone 6 New York added 10 cents to $3.06.

In Appalachia prices at most points also saw a bump. Columbia Gas gained 2 cents to $2.90, and Dominion South tacked on 4 cents to $2.51. Tetco M3 Delivery jumped 27 cents to $2.85.

At this early point in the cooling season, Appalachian prices are off to their best start since 2014, even as EIA data show regional production surpassing 25 Bcf/d, up roughly 3 Bcf/d year/year. Dominion South has averaged $2.09 month-to-date and $2.51 over the past seven trading days. That’s a noticeable improvement over prices averaging $1.92 in November 2016 and $1.24 in November 2015. Dominion South averaged $3.27 in November 2014, NGI data show.

In the Midcontinent, prices were mixed following some gains in Monday’s trading. ANR Southwest gave back 5 cents to finish at $2.68 after climbing 11 cents Monday. Panhandle Eastern gained 8 cents Tuesday to $2.66, while Northern Natural Demarcation traded up a cent to $2.98 after adding 7 cents Monday.

Out West, several points in California and Arizona/Nevada fell by double digits. SoCal Border Average dropped 14 cents to $2.86, while Kern Delivery and El Paso S. Mainline/N. Baja each fell 13 cents to $2.86.

PG&E Citygate dropped 6 cents to $3.03, while Malin also fell 6 cents, finishing at $2.75.

SoCal Citygate, still experiencing restrictions at several import points, moved higher, adding a nickel to $4.31, even as Sempra Energy’s Southern California Gas was forecasting demand on its system to fall through the rest of the week.

Genscape Inc. models showed demand in the California/Nevada region falling from 6.42 Bcf Tuesday to 5.92 Bcf Wednesday and 5.94 Bcf Thursday, even as forecasts called for above-normal temperatures in Southern California.

Genscape analyst Joseph Bernardi told NGI that this “could be due to a combination of temperatures re-entering CDD territory in the south while warming up but still remaining in very mild heating degree day territory further north.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |