Crescent Energy Co. has an agreement with Verdun Oil Co. II LLC to snap up oil-rich assets in the Uinta Basin, formerly held by EP Energy Corp., for $815 million.

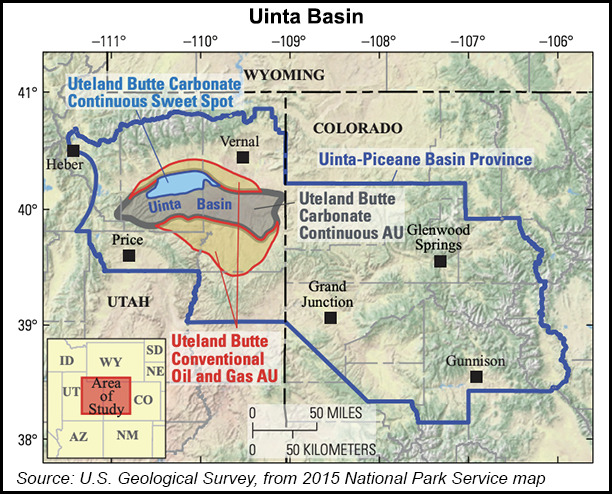

According to Houston-based Crescent, pro forma oil production nine months following the Uinta acquisition could increase to 134,000-148,000 boe/d from 114,000-124,000 boe/d. The assets, primarily over the Uteland Butte and Wasatch formations, would provide the company with 145,000 contiguous acres that are more than 85% held by production.

The package includes 400 producing vertical and horizontal wells, which “are a great addition to our existing Rockies footprint,” said CEO David Rockecharlie.

The exploration and production (E&P) firm noted that the Uteland Butte and Wasatch formations have multiple...