Cooler Near-Term Weather and Coronavirus Impacts Weigh on Weekly Natural Gas Prices

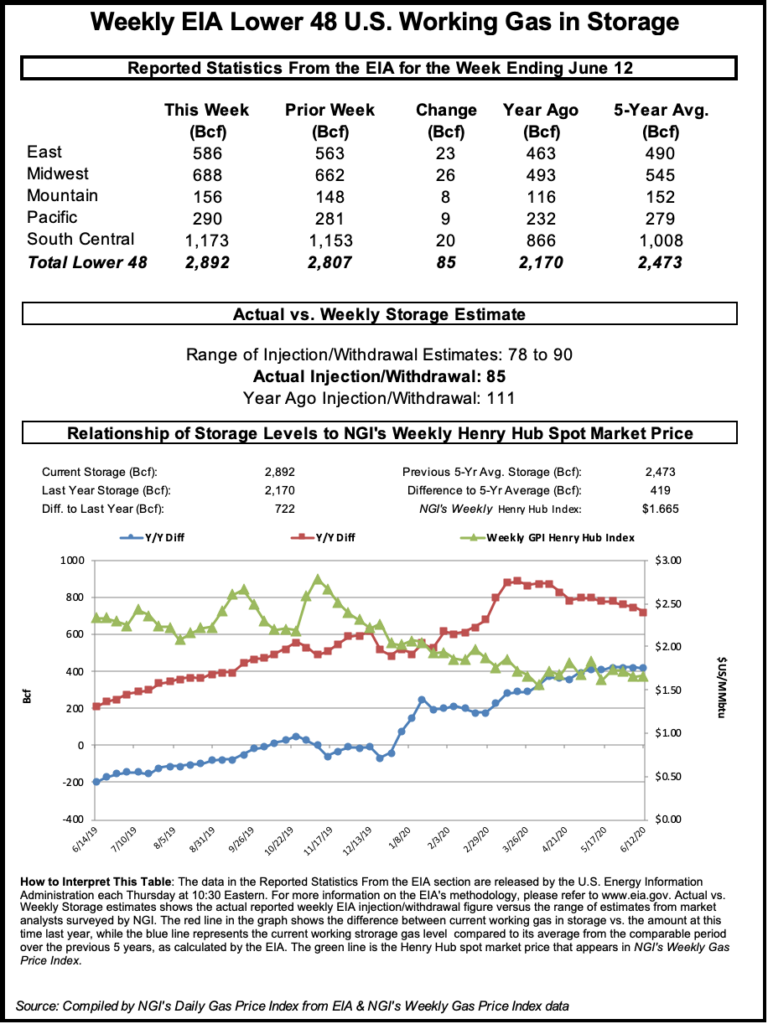

Rains and relatively mild temperatures across much of the eastern half of the Lower 48, along with festering fallout from the coronavirus pandemic, curbed weekly spot gas prices for the June 15-19 period.

NGI’s Weekly Spot Gas National Avg. declined 14.5 cents to $1.425.

Intense summer heat bore down on Texas and much of the Southwest throughout the week, but cooler temperatures prevailed at times over significant portions of the Midwest, East and other regions, minimizing energy demand to power air conditioners and weighing on spot prices.

“We need hotter weather to stimulate prices,” NatGasWeather said.

Bespoke Weather Services said that, absent more intense summer heat, catalysts for pricing momentum remained elusive during the week. Production levels were generally consistent and liquified natural gas (LNG) flows continued to decline, reflecting weak European and Asian demand as economies are only gradually recovering from the sudden blows delivered by the pandemic. At the same time, public-health officials are cautioning about the likelihood of new virus outbreaks amid increased consumer activity.

“Demand recovery has stalled for now,” Bespoke said, “with some concerns over virus resurgence, which is why we’d prefer to wait until we see more heat in the forecast before moving sentiment to the bullish side of the spectrum.”

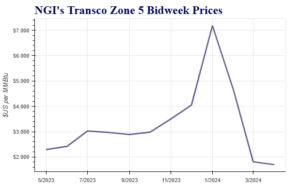

Markets across nearly every region posted double-digit declines, with the steepest losses, on average, in the Southeast, South Louisiana and East Texas.

At the close of the trading week, Katy was off 18.5 cents to $1.465, while Henry Hub lost 22.0 cents to $1.445. Elsewhere, Enable East fell 16.5 cents to $1.430

Natural gas futures struggled to find footing early in the week, losing ground both Monday and Tuesday, extending to three the number of consecutive trading days of losses. Futures lost nearly 20 cents over that stretch.

EBW Analytics Group said the loss Tuesday marked the 16th day during the second quarter when the Henry Hub spot price fell more than 10.0 cents below the front-month contract. By comparison, in the year earlier quarter, that did not happen once.

However, markets reversed course Wednesday, held steady Thursday and then made further gains to finish the week on Friday, with mid-range forecasts calling for more widespread heat and cooling demand late this month and into July, indicating some supply/demand tightening.

A rally may loom, EBW said. “Whether this occurs will depend in part on the intensity of late June and July heat and the ability of LNG feed gas flows to stabilize at or near current levels.”

The July Nymex gas futures contract finished the week at $1.669 /MMBtu, breaking even with Monday’s close.

The pandemic and its impacts on both domestic and global economies festers as a wildcard for LNG and demand broadly. Gas fed to LNG export plants continues at suppressed levels, a reflection of weakness across much of Europe and Asia, the two principal destinations for U.S. exports prior to the pandemic.

Economies are reopening across both continents, as is the case in the United States, developments that fuel optimism for increased energy demand. But there are also mounting concerns that with greater activity will come higher levels of unsafe social interaction and the potential for resurgences of virus outbreaks that could cause a second round of economic paralysis.

Early indicators lend weight to those concerns. State health officials on Friday reported 3,822 new cases in Florida, the highest single day number for the state to date. Florida has moved with relative haste to open its tourism-driven economy. Oklahoma and Arizona also reported record daily virus tallies.

Globally, the World Health Organization said the pandemic is accelerating anew, with more than 150,000 new cases on Thursday alone, a single-day high. During a press briefing broadcast on the WHO’s website Friday, the organization’s director, Dr. Tedros Adhanom Ghebreyesus, said treatment research is developing quickly, providing hope. But, he added, the disease is now spreading more rapidly than when much of the world was in lockdown mode.

“We are in a new and dangerous phase,” he said.

Against that backdrop, oil-and-gas producers remain skeptical. Despite a recovery in oil prices — West Texas Intermediate futures hovered around a three-month high of $40 bbl Friday – drillers idled 10 oil rigs, the latest Baker Hughes Co. data show. The natural gas rig count declined by three units during the week ended Friday, bringing the nationwide tally to 75, a record low in statistics that date to 1987.

With improved odds of heat in the coming days, spot gas prices climbed Friday across much of the Lower 48, with California a notable exception.

NatGasWeather noted a stalled weather system over much of the East that brought rain and moderate highs of 60s to 80s over the past week. But that is expected to move out, opening a door for increasing temperatures to start this week. Heat across Texas and much of Southwest, meanwhile, is holding steady.

Cash price gains were mostly modest, with relatively strong gains in the Southeast and Appalachia. Florida Gas Zone 3 jumped 6.5 cents day/day to average $1.525, while Dominion South climbed 4.0 cents to $1.350.

Emerson prices advanced 5.0 cents to $1.490, and PNGTS spiked 10.5 cents to $1.845.

In California, meanwhile, prices were off 4.5 cents on average, led lower by SoCal Citygate, down 10.5 cents to $1.580, and SoCal Border Avg., off 9.5 cents to $1.455.

On the pipeline front, Texas Eastern Transmission (Tetco) on Thursday provided an update on the amended corrective action order affecting its 30-inch diameter system. Beginning Saturday, Tetco was to reduce capacity at its Wheelersburg, OH, interconnect with Tennessee Gas Pipeline (TPG) to 49 MMcf/d to prevent further accumulation of shipper imbalances at the location, Genscape said.

Tetco has delivered an average of 174 MMcf/d to TGP over the last 14 days, with a maximum of 198 MMcf/d, creating a max impact of 148 MMcf/d, according to Genscape. The firm added that the restriction would remain in place until the imbalance is sufficiently reduced.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |