Bolstered by colder forecasts for late February into early March, natural gas futures advanced in early trading Thursday as the market prepared to price in the latest round of government inventory data.

The March Nymex contract was up 7.2 cents to $2.543/MMBtu at around 8:55 a.m. ET.

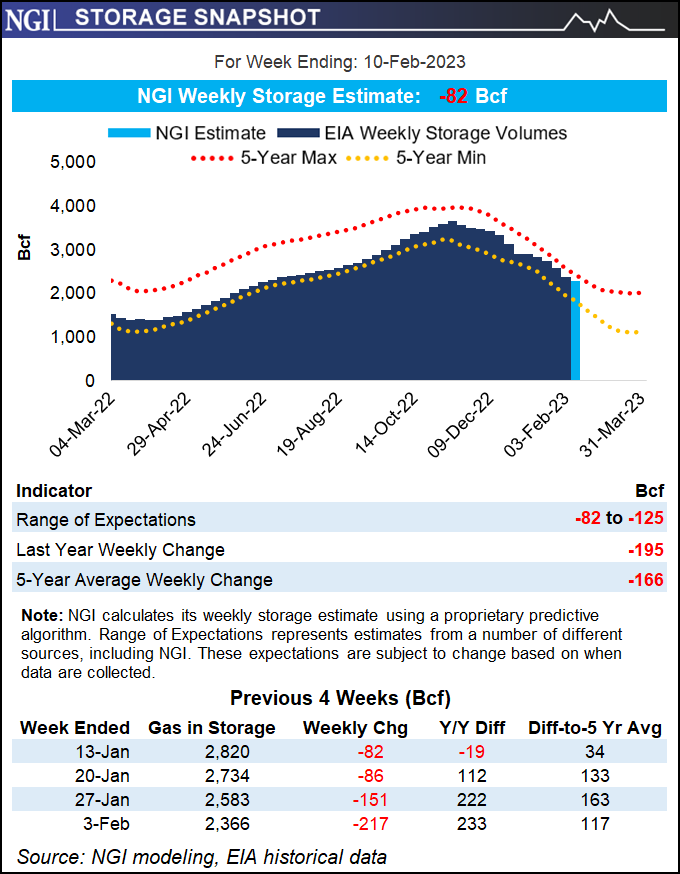

For the Energy Information Administration’s (EIA) latest natural gas storage report, scheduled for 10:30 a.m. ET, surveys point to another lighter-than-average winter withdrawal around 100 Bcf.

A Reuters survey of 14 analysts showed withdrawal expectations ranging from 82 Bcf to 125 Bcf, with a median draw of 109 Bcf. A Bloomberg poll produced a median draw of 96 Bcf, while a Wall Street Journal survey averaged at a 100 Bcf withdrawal. NGI modeled an 82 Bcf pull.

A pull in line with surveys...