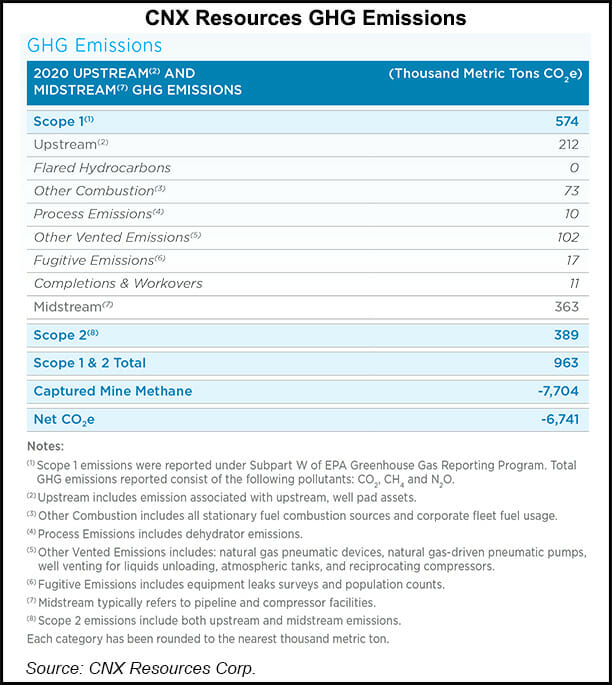

Appalachian pure-play CNX Resources Corp. said Wednesday that it’s net carbon negative for Scope 1 and 2 emissions, stressing a “tangible” accomplishment at a time when its peers are advancing ambitious goals to cut environmental footprints in the future.

Announced along with the release of its corporate responsibility report, the company said it believes it’s the only oil and natural gas producer or midstream operator that can currently claim net negative carbon emissions — not carbon zero, or carbon neutrality.

“Many in the energy industry and capital markets continue to speak in the abstract and distant future about ESG, sustainability, resiliency, carbon intensity and the industrial logic of consolidation,” said CEO Nick Deluliis. “CNX pursues a different path:...