Earnings | E&P | Haynesville Shale | Marcellus | NGI All News Access | NGI The Weekly Gas Market Report

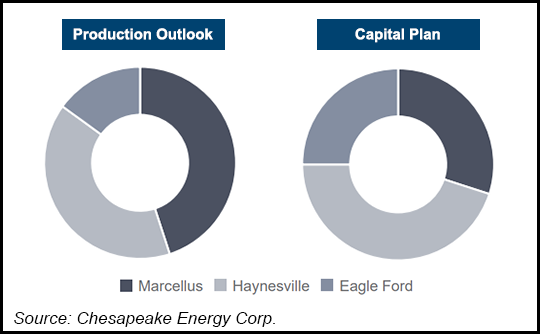

Chesapeake’s Natural Gas Prowess Growing Again in Marcellus, Haynesville, with Eye on LNG

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |