E&P | NGI All News Access | NGI The Weekly Gas Market Report

Canadian Oilsands Gas Demand Projected to Be Robust

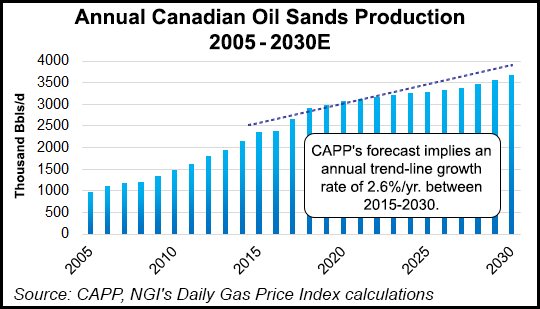

Canada’s biggest natural gas consumer — Alberta thermal oilsands production — will grow by 54% over the next 15 years, according to an industry survey.

An annual supply count by the Canadian Association of Petroleum Producers (CAPP) said the northern bitumen belt’s output is on its way up to 3.7 million b/d as of 2030 from the average 2.4 million b/d in 2015.

Current hard-times oil prices only lopped 400,000 b/d, or 7%, off the last CAPP reading of the Canadian development wave a year ago. Much of the dip is due to well depletion and reduced drilling outside the 140,000-square-kilometer (56,000-square-mile) oilsands region.

The nation’s total oil production of all types is rising by 38%to 5.5 million b/d as of 2030 from the 2015 average of 4 million b/d. Western bitumen growth is partially offset by depletion of eastern Canada’s aging trio of offshore oilfields on the Grand Banks of Newfoundland, where only one replacement project is under way.

The annual CAPP counts do not include natural gas consumption but differ only in detail from more complete production and fuel-use estimates by the Alberta Energy Regulator (AER) in annual provincial reserves surveys.

The 2016 edition of the AER report shows gas use by oilsands complexes, including their built-in heat and power cogeneration stations, rising by 62% to 4.7 Bcf/d as of the mid-2020s from a current average 2.9 Bcf/d.

Gas consumption is growing faster than bitumen production due to a changing supply development pattern. The biggest gas users have taken over the leading role.

Overall gas use in the oilsands averages one thousand cubic feet per barrel of bitumen output. But the benchmark masks wide variations in energy efficiency.

Open-pit mining and synthetic oil upgrader complexes operate below the average. But in-situ, or underground, extraction sites, relying on steam injections into deeper ore deposits, burn up to 2 Mcf of gas per barrel and at times even more depending on the age of the operations and the geological structures tapped.Their higher energy use is offset by lower construction costs and sponsor options to install them in smaller stages than the mines.

Trials of alternative oil and sand separation methods, such as solvent injections and microwave heating, are still in pilot plant stages. The first proposal for large-scale use of solvents, as a supplement to steam rather than a replacement, is in the regulatory application stage before the AER and the timing of plant construction will depend on market conditions following approval.

Over the next 15 years, CAPP’s survey shows oil sands mining production will grow by 50% to 1.5 million b/d from the current rate of one million b/d. In-situ output is on its way up by 61% to 2.1 million b/d from 1.3 million b/d.

CAPP said, “Growth in oilsands production could be higher than forecast if long-term crude oil prices return to previous high levels or if in-situ operators are able to respond to a lower price environment with greater cost efficiencies. The oilsands industry has a history of such innovation.”

In-situ plant sponsors currently hold approvals to add 1.8 million b/d to their total production eventually or more than double the new 800,000 b/d currently in active development stages, CAPP said.

Producers have fully booked the proposed 1.7 million b/d capacity of two export pipeline projects now advancing through regulatory and political approval processes: 590,000 b/d on Kinder Morgan Canada’s Trans Mountain route to the Pacific coast and 1.1 million b/d on TransCanada Corp.’s partial conversion of its gas Mainline for oil service to an Atlantic tanker port.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |