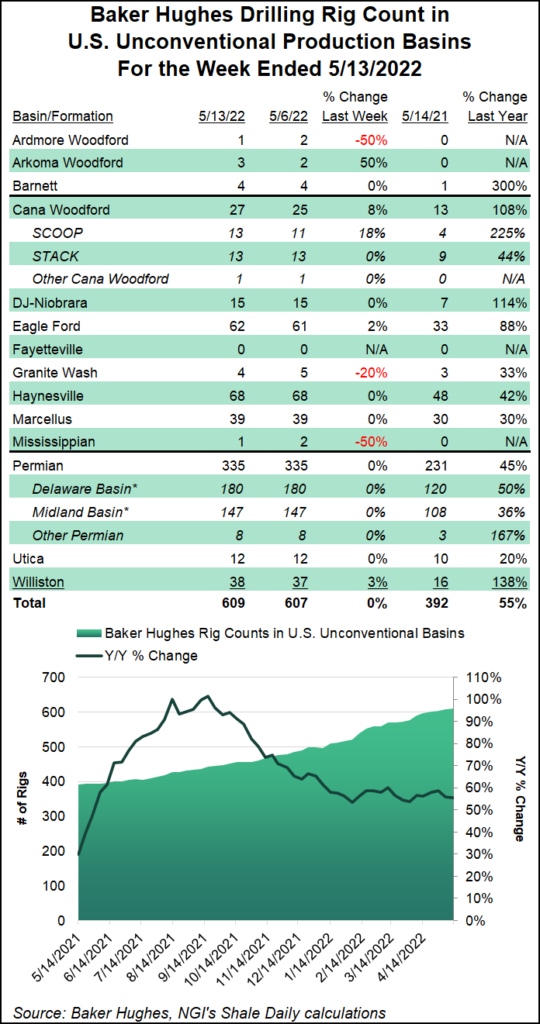

With gains spread across both natural gas- and oil-directed drilling, the U.S. rig count continued its upward climb during the week ended Friday (May 13), adding nine units to reach 714, according to the latest tally from Baker Hughes Co. (BKR).

Six oil-directed rigs and three natural gas-directed rigs were added in the United States for the week. Seven rigs were added on land, along with one in inland waters and one in the Gulf of Mexico. Five horizontal rigs were added domestically week/week, along with four directional rigs.

The combined 714 active U.S. rigs as of Friday compares with 453 rigs running in the year-earlier period. Since bottoming out at around 250 in 2020, the U.S. rig count has been posting steady gains ever since, according to the BKR numbers, which are...