E&P | NGI All News Access | NGI The Weekly Gas Market Report

BHGE Orders Hit $6B in 2Q, While Synergies from Merger Escalate

One year after General Electric Co. (GE) combined its estimable oilfield services business with Baker Hughes Inc., the company is working to secure oilfield business in an increasingly competitive market, a strategy that appeared to pay dividends during the second quarter.

Houston-based Baker Hughes, a GE company (BHGE), reported orders reached $6 billion in 2Q2018, a 15% sequential increase and 9% higher year/year.

“In the second quarter, we delivered $6.0 billion in orders and $5.5 billion in revenues,” CEO Lorenzo Simonelli said during a conference call last Friday. “We delivered $189 million of synergies in the quarter and are on track to achieve the $700 million target for the year.”

The total book-to-bill ratio in the quarter was 1.1; equipment book-to-bill ratio in the quarter was 1.2.

“Twelve months ago, we created BHGE to deliver differentiated solutions for our customers and provide a unique investment opportunity for our shareholders,” Simonelli said. “Since closing, we have executed on the integration, secured important commercial wins and delivered superior performance for our customers. We also made progress on our priorities of gaining market share, increasing margin rates and delivering strong free cash flow.”

Still, the gains don’t appear to be enough for GE, which spent billions to become the majority shareholder with a 62.5% stake. In June it said it would fully separate from BHGE within three years, which puts more pressure to deliver in the interim.

Margins for the BHGE oilfield services business during 2Q2018 climbed more than 550 basis points (bp) from a year ago.

The oilfield equipment segment “had our largest orders quarter since 2015, winning significant subsea production awards across six different projects,” Simonelli said. “Our book-to-bill ratio in the quarter was 1.7, a clear sign of our ability to win big projects with a collaborative partnership approach and our leading gas technology.”

For the turbomachinery and process solutions (TPS) segment, which centers around liquefied natural gas (LNG) projects, “our priorities are centered on LNG leadership, services capability, growth in the industrial space and cost-out,” said the CEO. “In the quarter, we secured important commercial wins in LNG and on-and-offshore production, two of the largest drivers of our TPS segment. We also advanced our cost-out initiatives and expect these to materialize into improved margins in 2019.”

The digital solutions segment delivered more than 450 bp of margin expansion from a year ago.

“We are seeing increased interest from customers in our sensor, inspection and software offerings, and we are gaining traction with our predictive corrosion management software to support the growing corrosion market,” said the CEO.

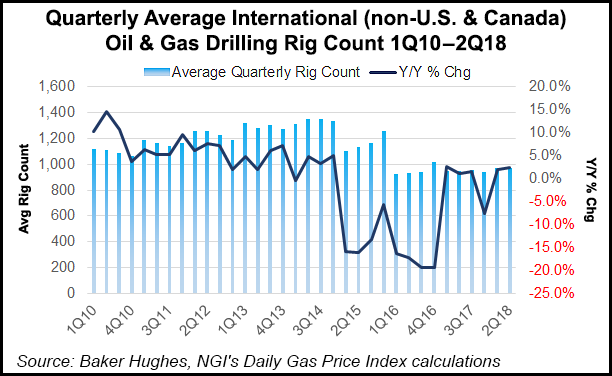

“The macro outlook continues to be favorable. North American production is increasing as operators grow rig and well counts, and we are seeing signs of increasing international activity in some geomarkets. Our portfolio mix positions us well for short and long-term growth as the market improves and the next wave of customer projects come into view.”

Net losses totaled $19 million (minus 5 cents/share) from sequential profits of $70 million (17 cents). Operating income totaled $78 million, versus a sequential loss of $41 million, while cash flow fell to $139 million from $294 million.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |