Markets | NGI All News Access | NGI Data

Bearish Miss from EIA at 84 Bcf; Natural Gas Futures Tumble

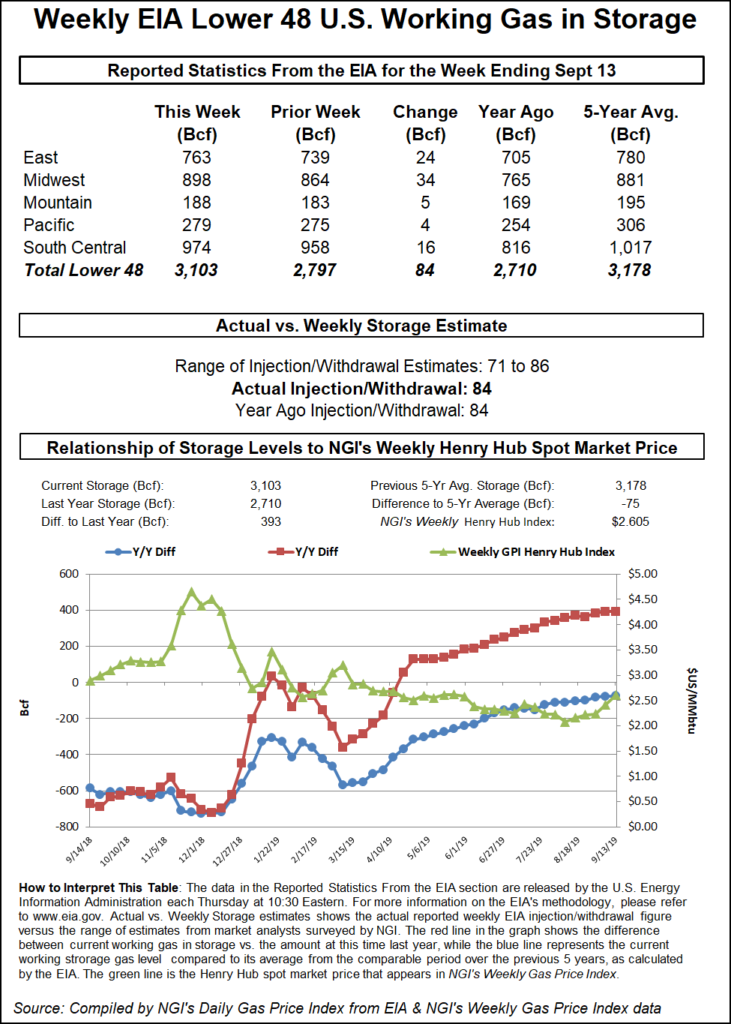

The Energy Information Administration (EIA) on Thursday reported an 84 Bcf weekly injection into U.S. natural gas stocks, bearish versus expectations, and futures prices gave up close to a nickel on the news.

The 84 Bcf injection for the week ended Sept. 13 matches the 84 Bcf build EIA recorded for the year-ago period and is slightly higher than the five-year average 82 Bcf injection.

As the number crossed trading screens at 10:30 a.m. ET, the October Nymex contract, already down several cents in early-morning trading, sold off further, from around $2.590/MMBtu to as low as $2.555. Over the next half hour, the prompt month probed as low as $2.545. By 11 a.m. ET, October was trading around $2.556, off 8.1 cents from Wednesday’s settle.

Prior to the report, market observers had been looking for a build in the upper 70s Bcf, with predictions ranging from 71 Bcf to 85 Bcf. Intercontinental Exchange futures had settled at 81 Bcf, while NGI’s model predicted a 79 Bcf build.

“Any number in the ballpark of 84 Bcf is bearish in terms of balances given how hot the pattern was” and given lower production and rebounding liquefied natural gas feed gas volumes during the period, Bespoke Weather Services said. “Prices have responded accordingly, but with injections only projected to get larger, the decline may not be finished yet, with $2.50 looking likely soon.”

By region, the Midwest posted the largest weekly injection at 34 Bcf, followed by the East, which refilled 24 Bcf for the week. The Mountain region injected 5 Bcf, while the Pacific injected 4 Bcf. In the South Central, 15 Bcf was injected into nonsalt stocks, along with 1 Bcf into salt, according to EIA.

Market observers discussing the EIA report during a weekly chat on Enelyst looked to a higher-than-expected build in the South Central region as a possible driver of the bearish miss.

That said, injections into salt stocks the past two weeks have lagged the five-year average, according to Het Shah, Enelyst’s managing director.

“Are the cash-to-winter spreads not enough to get the salt operator/contract holders moving?” Shah said.

Total Lower 48 working gas in underground storage ended the week at 3,103 Bcf, 393 Bcf (14.5%) above year-ago levels but 75 Bcf (minus 2.4%) lower than the five-year average, according to EIA.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |