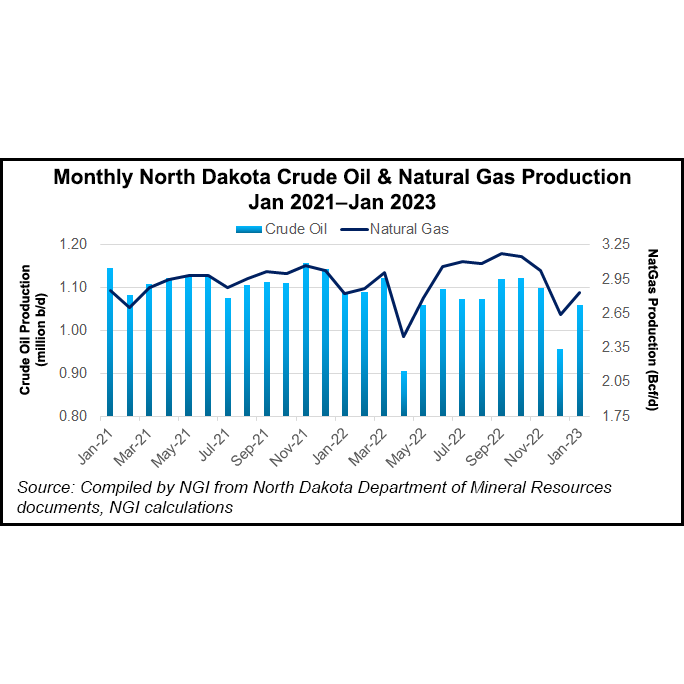

Bakken Shale natural gas prices remain at pandemic-era lows amid an overall softening of the North American market, according to North Dakota’s Department of Mineral Resources (DMR).

The price of natural gas delivered to TC Energy Corp. and Oneok Inc.’s Northern Border pipeline system at Watford City, ND, stood at $2.08/Mcf as of Wednesday (March 15).

“Natural gas prices are really in the tank,” DMR’s Lynn Helms, Oil and Gas Division director, said during a press briefing.

He cited that U.S. natural gas storage inventories currently sit comfortably above the five-year average for this time of year, a bearish indicator.

Due to regulatory and investor pressure to stamp out routine gas flaring, low prices put “a lot of stress on the system,” Helms said....