Bakken Producers Raised Production During First Quarter

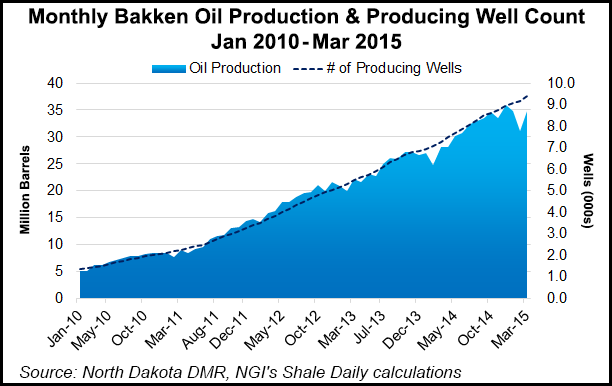

First quarter oil production among four of the North Dakota Bakken Shale’s largest producers increased during a period of severely depressed commodity prices.

Led by Oklahoma-based Continental Resources Inc., the big operators continued to increase production even with far fewer rigs working than a year earlier. Down from 19 at the end of last year, Continental said it plans to average about 10 operating rigs this year, and it averaged 13 in 1Q2015 (see Shale Daily, May 7).

The other big guys — New York City-based Hess Corp., Denver-based Whiting Petroleum, and Houston-based EOG Resources (see Shale Daily, May 5) — reported similar first quarter results.

Production for Continental was up 4% in the quarter compared to the same period last year, hitting 206,829 boe/d. But financial results were not as robust, reporting a $132 million (minus 36 cents/share) loss, or $33.8 million (minus 9 cents/share) on an adjusted basis. The red ink comes even with 23% and 15% reductions in average cash costs per barrel and drilling and completion costs in 2014, respectively.

Whiting Petroleum saw a record average of 133,500 boe/d in the Bakken/Three Forks in the first quarter, an increase of 82% from 1Q2014 (73,325 boe/d), but that was prior to its Kodiak Energy Inc. acquisition last year. “The Bakken/Three Forks represented 80% of Whiting’s total 1Q2015 production,” the company said.

At the same time, like Continental, Whiting reported a $106.1 million net loss for the quarter, compared to $109.1 of net income in the first quarter last year. In all of its principal areas in Dunn, Williams and McKenzie counties, the initial production rates were two to three times greater than the 30-day average daily production numbers per well, Whiting said.

Initial daily production ranged from 2,500 boe/d to 3,100 boe/d, whereas in each of those same areas the daily averages on a 30-day basis dropped to a range of 1,100 boe/d to 1,400 boe/d, according to Whiting.

Further supporting the first quarter trend, Hess Corp. reported a 70% increase in 1Q2015 Bakken production (108,000 boe/d), compared to the same period last year when the company experienced “constrained production” along with continued drilling activity in this year’s low-price environment.

Hess said it brought 70 gross operated wells on production in North Dakota in 1Q2015, and its drilling/completion costs per operated well averaged $6.8 million, a drop from $7.5 million per operated well a year earlier.

Financial results did not follow, with Hess reporting a $389 million net loss for 1Q2015, compared to net income of $386 million for the same period last year.

Another of the Bakken major players, EOG Resources, said it had no intention of accelerating oil production “at the bottom of the commodity cycle,” and it is waiting for a strong upswing in prices before it will resume production growth. Nevertheless, in the Bakken and the Rockies, EOG said it was able to “continue to generate efficiency gains and lower well costs” through various operational improvements.

“Average well costs in 1Q2015 were down 14%,” EOG reported in the quarterly financial report that included a $169.7 million loss (minus 31 cents/share) for the period, compared to $660.9 million ($1.21/share) in profits for the first quarter in 2014.

The fifth big producer in the Bakken, internationally focused Statoil, does not break out its production for its U.S. plays, but the overall global results for the Norwegian-based company included a 1Q2015 loss.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |