Jeremiah Shelor joined NGI in 2015 after covering business and politics for The Exponent Telegram in Clarksburg, WV. He holds a Master of Fine Arts in Literary Nonfiction from West Virginia University and a Bachelor of Arts in English from Virginia Tech.

Archive / Author

SubscribeJeremiah Shelor

Articles from Jeremiah Shelor

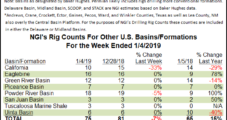

Declines in Oil Patch Drive Baker Hughes U.S. Rig Count Lower

The U.S. rig count fell eight units to 1,075 for the week ended Friday (Jan. 4), driven by a pullback in oil-directed drilling, according to data from Baker Hughes, a GE Company (BHGE).

U.S. Natural Gas Rig Count Flat but Oil Drilling Drops, Says BHGE

The U.S. natural gas patch held steady at 198 rigs for the week ended Friday (Jan. 4) as a pullback in oil-focused activity paced an overall decline in domestic drilling activity, according to data from Baker Hughes, a GE Company.

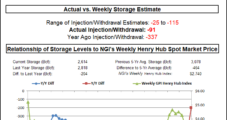

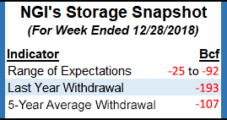

Bulls Unphased by Loose EIA Print as Natural Gas Futures Rise on Potential Return of January Cold

The natural gas futures market managed to shake off a particularly bearish government storage report Friday as forecasts for a potential shift to colder temperatures later this month seemed to inspire some buying after recent declines.

Potential January Cold Helps Natural Gas Futures Shake Off Bearish EIA Storage Report

The natural gas futures market managed to shake off a particularly bearish government storage report Friday as forecasts for a potential shift to colder temperatures later this month seemed to inspire some buying after recent declines.

Bearish First Week of 2019 for Natural Gas Markets as Mild Temps Take Pressure Off Storage

Continued mild weather to start the new year meant storage fears — and natural gas prices — continued to fade during the week ended Friday (Jan. 4); selling across most of the Lower 48 saw theNGIWeekly Spot Gas National Avg. drop 26.5 cents to $2.805/MMBtu.

Mild January Forecast Brings Bears Out of Hibernation as Natural Gas Futures, Spot Prices Under Pressure

Forecasts showing overall mild conditions through mid-January continued to pressure natural gas futures lower Thursday as traders looked ahead to another potentially bearish government storage report. In the spot market, expectations for Lower 48 weather-driven demand to ease into next week accompanied declines across most regions; the NGI Spot Gas National Avg. slid 11.5 cents to $2.690/MMBtu.

Natural Gas Futures, Spot Prices Under Pressure as Mild Temps Seen Through Mid-January

Forecasts showing overall mild conditions through mid-January continued to pressure natural gas futures lower Thursday as traders looked ahead to another potentially bearish government storage report. In the spot market, expectations for Lower 48 weather-driven demand to ease into next week accompanied declines across most regions; the NGI Spot Gas National Avg. slid 11.5 cents to $2.690/MMBtu.

NatGas Markets Ring in New Year With Return to Sub-$3 as January Forecasts Seen Bearish

A new year brought a new outlook for natural gas markets Wednesday, with a mild forecast for the first half of January bringing a return to sub-$3 prices as the storage concerns that drove up risk premiums earlier in the heating season appear largely assuaged. Influenced by sagging futures, spot markets struggled through a post-New Year’s hangover, though a few locations in the West gained ahead of cold temperatures and precipitation expected this weekend; the NGI Spot Gas National Avg. tumbled 26.5 cents to $2.915/MMBtu.

Bearish January Forecasts Sink Natural Gas Below $3 to Start 2019

A new year brought a new outlook for natural gas markets Wednesday, with a mild forecast for the first half of January bringing a return to sub-$3 prices as the storage concerns that drove up risk premiums earlier in the heating season appear largely assuaged. Influenced by sagging futures, spot markets struggled through a post-New Year’s hangover, though a few locations in the West gained ahead of cold temperatures and precipitation expected this weekend; the NGI Spot Gas National Avg. tumbled 26.5 cents to $2.915/MMBtu.

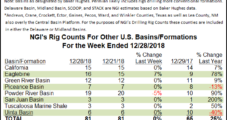

Baker Hughes U.S. Rig Count Steady as Industry Closes Book on 2018

The U.S. oil and natural gas rig count climbed by three to 1,083 for the week ended Friday (Dec. 28), nearly bringing to a close a year of growth in domestic drilling activity, according to data from Baker Hughes, a GE Company (BHGE).