Jeremiah Shelor joined NGI in 2015 after covering business and politics for The Exponent Telegram in Clarksburg, WV. He holds a Master of Fine Arts in Literary Nonfiction from West Virginia University and a Bachelor of Arts in English from Virginia Tech.

Archive / Author

SubscribeJeremiah Shelor

Articles from Jeremiah Shelor

Storage Sinks Natural Gas Futures into October Expiry as Triple-Digit Build Surprises

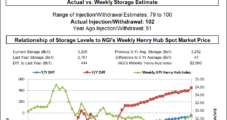

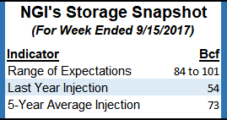

Natural gas futures bulls hoping for a strong finish for the October contract on its last day of trading Thursday had those hopes dashed by a very bearish surprise from the latest government storage report. After trading as low as $2.390/MMBtu, the October Nymex contract rolled off the board at $2.428, down 7.4 cents. The November contract lost 7.5 cents to settle at $2.443.

Gulf Coast Express Start-Up Seen Weighing on Prices as Natural Gas Futures Called Lower

Natural gas futures were down early Wednesday as traders and analysts mulled the market implications of the official start-up of Gulf Coast Express (GCX), a major pipeline set to unleash additional Permian Basin supply. The October Nymex contract was down 1.7 cents to $2.486/MMBtu at around 8:40 a.m. ET; November was off 2.1 cents to $2.504.

West Texas Cash Rises on Gulf Coast Express Start-Up; Natural Gas Futures Ease

Natural gas futures couldn’t hold onto early gains Tuesday as traders weighed near-term hot temperatures against the prospect of weaker heating demand heading into next month. After trading as high as $2.590/MMBtu in the early-morning hours, the October contract steadily declined over the course of the day, eventually settling at $2.503, off 2.4 cents. November slid 3.0 cents to settle at $2.525.

Natural Gas Futures Steady Ahead of EIA Report, October Expiry

Natural gas futures traders seemed to be keeping their powder dry Wednesday as they looked ahead to both a new round of government inventory data and the front-month expiration. After trading as high as $2.519/MMBtu and as low as $2.455, the October contract, set to expire Thursday, eventually settled close to even at $2.502, off a tenth of a penny. November settled 0.7 cents lower at $2.518.

Near Record Heat Forecast for South as Natural Gas Futures Called Higher

Forecasts showing more summer-like temperatures lingering across parts of the Lower 48 over the next week or so helped lift natural gas futures in early trading Tuesday. The October Nymex contract was up 2.0 cents to $2.547/MMBtu at around 8:40 a.m. ET.

Natural Gas Futures Steady as Analysts Predict String of Large Fall Injections

The natural gas futures market marked the official start of fall with a quiet trading session Monday; a key support level held as traders mulled the prospect of large injections in the weeks ahead. The October Nymex contract settled at $2.527/MMBtu, down 0.7 cents after probing as low as $2.493 in the early-morning hours, while November finished unchanged at $2.555.

‘Warm-Biased’ Pattern Bearish into October as NatGas Futures Slide; Permian Gulf Coast Express Start-Up Official

Natural gas futures couldn’t hold onto early gains Tuesday as traders weighed near-term hot temperatures against the prospect of weaker heating demand heading into next month. After trading as high as $2.590/MMBtu in the early-morning hours, the October contract steadily declined over the course of the day, eventually settling at $2.503, off 2.4 cents. November slid 3.0 cents to settle at $2.525.

Above-Normal Forecast Seen Bearish Longer-Term as Natural Gas Futures Called Lower

Despite higher weather-driven demand in the latest forecasts, natural gas futures were trading lower early Monday as above-normal temperatures are expected to start having a bearish impact deeper into the shoulder season. The October Nymex contract was down 2.4 cents to $2.510/MMBtu shortly after 8:40 a.m. ET.

Market Still Seen Oversupplied as Natural Gas Futures Slide

With supportive late-season heat expected to start eating into heating demand soon, and with the market continuing to look oversupplied, natural gas futures eased lower Friday. The October Nymex contract slid 0.4 cents to $2.534/MMBtu, while November dropped 1.4 cents to $2.555.

First Day of Fall Leaves Natural Gas Futures Mostly Unchanged

The natural gas futures market marked the official start of fall with a quiet trading session Monday; a key support level held as traders mulled the prospect of large injections in the weeks ahead. The October Nymex contract settled at $2.527/MMBtu, down 0.7 cents after probing as low as $2.493 in the early-morning hours, while November finished unchanged at $2.555.