Jamison Cocklin joined the staff of NGI in November 2013 to cover the Appalachian Basin. He was appointed Senior Editor, LNG in October 2019, and then to Managing Editor, LNG in February 2024. Prior to joining NGI, he worked as a business and energy reporter at the Youngstown Vindicator, covering the regional economy and the Utica Shale play. He also served as a city reporter at the Bangor Daily News and did freelance work for the Associated Press. He has a bachelor's degree in journalism and political science from the University of Maine.

Archive / Author

SubscribeJamison Cocklin

Articles from Jamison Cocklin

Consol Sells More Coal to Pay Down Debt, Focus On NatGas Production

Continuing its transition to an exploration and production-focused natural gas producer, Consol Energy Inc. said Monday that it has entered an agreement to sell its premiere Buchanan Mine and associated metallurgical coal assets in three states for $420 million.

Ohio Pure-Play Eclipse Resources Faces NYSE Delisting

Ohio pure-play Eclipse Resources Corp. said it has received a delisting notice from the New York Stock Exchange (NYSE) because the price of its common stock has fallen below the continued listing standard.

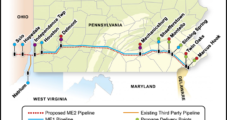

Lawsuits, Downturn Could Cause More Delays For Embattled Mariner East Pipeline Project

Legal challenges against Sunoco Logistics Partners LP’s proposed Mariner East (ME) pipelines are mounting, as Pennsylvania landowners and an environmental advocacy group are fighting against a subsidiary’s efforts to condemn property for the project’s path. The court battles could combine with the commodities downturn to delay the project further.

Range Continues Divesting Noncore Assets With Northeast Pennsylvania Sale

Continuing its plans to divest noncore assets and generate more cash for its balance sheet, Range Resources Corp. said Friday it has agreed to sell 11,000 non-operated acres in Bradford County, PA, to an undisclosed operator for $112 million.

Hedges, Firm Transport Lift Antero to Profit in 2015

Appalachian pure-play operator Antero Resources Corp. rode a strong hedge book and solid firm transportation (FT) portfolio to buck last year’s trend of losing money and revenue, reporting a profit for both the fourth quarter and full year.

Pennsylvania DEP Pushing Well Site Restoration on Oil/Gas Producers

The Pennsylvania Department of Environmental Protection (DEP) is responding to requests it made last year that all oil and natural gas producers in the state restore inactive well sites, and it has issued notices of violation (NOV) to Range Resources Corp. and EQT Corp. for not complying in a timely manner.

Low Gas Prices, Well Declines Lead to Revised Utica EURs at Rice Energy

Facing low natural gas prices and with more production data on hand, Rice Energy Inc. said Thursday that it would increase the spacing between its Ohio Utica Shale wells and revise estimated ultimate recoveries (EUR) in the play.

Rice Energy Highlights Deal to Help Fund 2016 Budget Without Debt

Rice Energy Inc. disclosed late Tuesday the terms of a previously announced $500 million equity investment, revealing that the institutional investment firm EIG Global Energy Partners (EIG) would provide $375 million up front for a stake in the company’s midstream assets in Ohio and Pennsylvania (see Shale Daily, Dec. 21, 2015).

MarkWest Continues Response to 3,000 Gallon Chemical Spill in West Virginia

MarkWest Energy Partners LP continued to lead environmental remediation efforts in Wetzel County, WV, on Tuesday, three days after the company discovered that 3,000 gallons of chemicals had leaked from its Mobley Processing Facility.

Gastar Exits Appalachian Basin, Sells Marcellus/Utica Assets to Tug Hill

Gastar Exploration Inc. said Monday that it would sell its Marcellus and Utica shale assets to an affiliate of privately held investment developer Tug Hill Inc. for $80 million and exit the Appalachian Basin in favor of its Midcontinent assets. The company added, however, that it would mostly suspend exploratory drilling there until 2017 on low oil and gas prices.