Brad Hitch has spent more than 23 years working in LNG and natural gas trading from London and Houston. He currently works as an adviser to new market entrants, and he has held senior trading and origination positions at Barclays, Cheniere Energy Inc., Enron Corp., Merrill Lynch and Williams. With experience that includes establishing one of the first LNG trading desks, he has participated in various stages of the global gas market’s evolution. During his time at Merrill Lynch, he worked as head strategist on the European gas desk and led an initiative to enter the LNG trading market. Prior to returning to Houston, he worked for Cheniere in London and was primarily responsible for establishing and managing a derivative trading function. He holds an MBA from the Wharton School at the University of Pennsylvania and a BA from the University of Kentucky.

Archive / Author

SubscribeBrad Hitch

Articles from Brad Hitch

Will Europe’s Call for LNG Weaken This Summer as Storage Enters Season Strong? – Column

Notwithstanding the fact that temperatures in Northwest Europe can stay cool through April or later, March 31 is a good date to think of as the “end of winter” for European gas markets.

Understanding Europe’s Outsized Role in the U.S. Natural Gas Market – Column

Evaluating the European gas market is one of the natural first steps for anyone looking to measure the impact of LNG on the U.S. natural gas market.

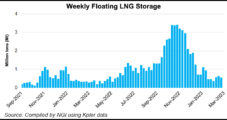

Understanding LNG’s Impact on the U.S. Natural Gas Market Via Shipping and Floating Storage – Column

Growth in U.S. LNG capacity has reached the point where it is a significant demand component of the country’s expansive natural gas market.

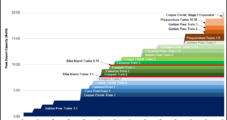

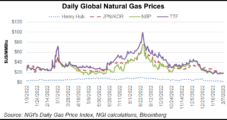

Global Gas Trade Needs a Better LNG Index, but Finding the Keys to Unlock It Will Take More Time – Column

How close is the world to adopting a global spot LNG index? That’s a question this series has aimed to answer by exploring the prospects of establishing one based on crude oil, Title Transfer Facility (TTF) and Henry Hub prices.

Can the Search for a Global LNG Benchmark End With a European or U.S. Natural Gas Contract? – Column

While the early LNG market mostly developed in Asia and the Middle East, the super-chilled fuel was first commercialized in the United States and Europe.

Column: Back to the Future with Oil in Search of a Global LNG Price Index

Experienced commodity professionals, upon encountering the LNG market for the first time, will often note the lack of a globally recognized liquefied natural gas price benchmark.

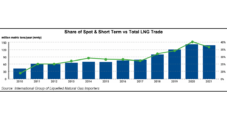

Column: Are U.S. Natural Gas Producers Ready to Enter the LNG Market, and Is There a Place for Them?

Ten years have passed since Cheniere Energy Inc. ushered in the era of modern U.S. LNG exports by sanctioning the first two liquefaction trains at the Sabine Pass terminal in Louisiana.