Utica Shale | E&P | Marcellus | NGI All News Access

Ascent CEO says Ohio Utica Potential Not Yet Fully Realized

The chief of Ohio’s largest natural gas producer sees plenty of running room in the Utica Shale, a play he said is not yet fully delineated or being developed to its maximum potential.

In a rare public appearance before an industry audience in the Appalachian Basin, Ascent Resources LLC CEO Jeff Fisher said the Ohio pure-play is poised for growth this year at a time when other operators in the region are scaling back. The company’s assets span all three phases of the Utica in southeast Ohio, which Fisher said is both an advantage and an opportunity to learn more about a play that’s often overshadowed by its younger cousin the Marcellus Shale.

“Those are pretty distinctive,” Fisher said of the Utica’s dry and wet gas windows, along with its oil phase. “We think that gives us hydrocarbon diversity, different economics, different markets, and we see that as a big advantage.

“Certainly, the dry gas window has been extremely prolific,” he told a crowd gathered for Hart Energy’s annual Dug East Conference and Exhibition in Pittsburgh. “I’ve seen a lot of shale plays, I’ve drilled a lot of horizontal plays — this play matches anything I’ve ever participated in before.”

Ascent had its beginning in 2013 after the late Aubrey McClendon was ousted from the helm of Chesapeake Energy Corp. He founded American Energy Partners LP (AELP) to develop affiliates with basin-specific strategies across the country. Once American Energy Appalachia Holdings LLC, Ascent eventually rebranded and became independent.

Fisher, a McClendon protege who was on the executive team at Chesapeake, said Ascent chose Ohio because much of the company’s team had drilled some of the Utica’s first unconventional discovery wells. Chesapeake was a Utica pioneer, delivering the play’s first commercial production in Ohio.

Ascent is now the state’s No. 1 natural gas producer and the nation’s eighth largest, according to Fisher. While the first two years of the company’s existence were “frankly a time of survival,” Ascent’s move to raise $1.5 billion of capital in 2016 transformed it. By the following year, it had doubled its production and was running a six-rig program. In 1Q2019, the company produced 1.6 Bcfe/d including more than 26,000 bbl of liquids from a 350,000-acre position.

At a time when public exploration and production (E&P) companies are cutting back in response to prudent shareholders searching for better returns and commodity headwinds, Fisher said Ascent is aiming for substantial growth this year, with some of that carried over from 2018 and some by design.

“For us, getting to full scale in 2019 is kind of where we are positioning the company,” he said.

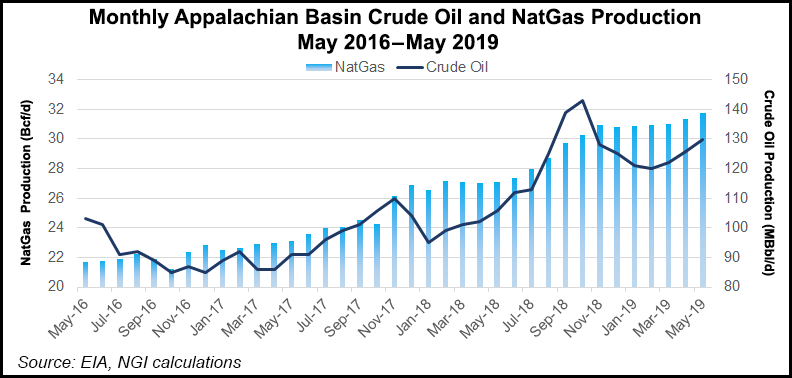

Moving forward, Ascent sees big opportunities in the Utica, where E&Ps produced nearly 2.4 Tcf last year. That’s compared to more than 6 Tcf of production in nearby Pennsylvania, which was largely driven by the Marcellus Shale over the same time.

“The dry gas is phenomenal,” Fisher said. “I think what is less known about the Utica is the liquids-rich, the volatile oil window.”

Fisher said the Utica’s rock quality is superb, with a top seal that allows for twice the normal reservoir pressure of other plays, top and bottom fracture barriers that result in better stimulation and a lower water saturation that means more hydrocarbons. Those characteristics are touted commonly by the play’s leading operators, but Fisher said there aren’t enough companies developing the asset.

“The Utica, I think, is still a bit misunderstood,” he said. “There’s not a large public champion of the play,” he said. “There are smaller” public companies “that are more focused in maybe the Marcellus or in other positions.”

While full-scale development in the Ohio Utica didn’t really begin until around 2013, its two leading players are today privately owned. Ascent is backed primarily by the Energy and Minerals Group, First Reserve Corp. and Riverstone Holdings LLC. The other, Encino Energy LLC, is backed by the Canada Pension Plan Investment Board. Encino took over Chesapeake’s large Ohio position earlier this year after the former pioneer exited the play in a $2 billion deal.

Other operators at Dug East, however, see similar benefits in the Utica and intend to explore them. Equinor ASA’s Nicole Baird, asset manager, said the Appalachian Basin features prominently in its global oil and gas portfolio. While the company has sizeable nonoperated positions in Pennsylvania and West Virginia, Ohio is its primary focus in the Northeast, where it has an operated program that spans 27,000 net acres in Monroe County.

Over the last three years, Baird said Equinor has increased Appalachian production by 40%, exiting 2018 producing 300 MMcf/d. In Ohio, the Norwegian-based producer is focused on improving efficiency, reducing units costs and boosting production further, she said.

Equinor is reducing costs with longer laterals like many other operators across the Lower 48. Since 2015, the company has increased the lateral lengths of its Utica wells by 140%, with horizontals stretching on average 14,000 feet last year. Based on its current plans, Baird said 25% of the future inventory in the play would have lateral lengths of more than 18,000 feet, allowing the company to drill fewer wells and cutting the number of pads needed to maximize production.

“Although our operated production in Ohio has been focused on the Utica/Point Pleasant,” Baird added, “We have been actively testing the Marcellus in Ohio.”

Equinor isn’t alone in testing the potential of the Marcellus in the Buckeye State, but the formation is underexplored there. According to state records, while 2,626 Utica wells have been drilled, only 44 Marcellus wells have been spud.

Equinor is zeroing-in on co-development of both plays. The company is currently completing a Marcellus well that it drilled last year. The pad would be its first fully co-developed operation when completed, with four Utica wells, four Marcellus wells, a legacy Utica well and two other legacy Marcellus wells set to be in production.

“We are excited to see how modern completions in the Marcellus will perform when we start expanding the reach into Ohio,” Baird said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |