NGI The Weekly Gas Market Report | Coronavirus | E&P | Earnings | LNG Insight | NGI All News Access

As 1Q Results Await, U.S. E&Ps Facing Investors on Responses to Covid-19, from Capex Cuts to Shut-ins

Oil and natural gas development began to fall off a cliff in March from Covid-19 and the poorly timed price war, but initial earnings results for the first quarter point to an even sharper downturn through June, at a minimum.

The exploration and production (E&P) sector in general isn’t set to unveil final first quarter results for another week or so. However, Schlumberger Ltd., Halliburton Co. and Baker Hughes Co., along with a slew of specialty oilfield services operators, including Patterson-UTI Inc., foresee a slump in spending by E&P customers through at least mid-year.

“Preserving liquidity and cash will be the primary focus for E&P companies over the coming months,” said NGI’s Patrick Rau, director of Strategy & Research. “Expect to hear a lot of ”we are controlling the things we can control’ from producers this quarter.”

Investors likely want to hear about near-term debt maturities, he said, “and there is little doubt banks are using a more conservative forward price deck for oil and gas these days. For that reason, any success in maintaining the borrowing base on credit revolvers, or the ability for producers to refinance debt at acceptable terms, would be a significant positive for the industry, especially in this commodity pricing environment.”

The message from E&Ps won’t only focus on cutting capital expenditures (capex), but rather, how quickly can they reduce their spending, Rau said.

“Similarly, this quarter might be the first time during the shale revolution that E&P companies bend over backward to tell you how quickly they are getting wells offline, instead of the other way around.”

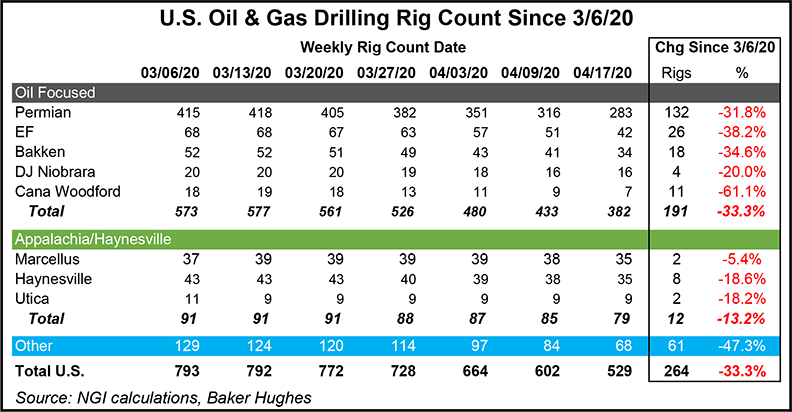

The oil-focused producers might sound a bit more cautious during the quarterly conference calls because they have borne the brunt of the plummet in the U.S. rig count. Since March 6, said Rau, rigs in the major oil-focused basins of the Lower 48 have declined by almost three times more than the combined rig total in the gassy Appalachian Basin and in the Haynesville Shale.

Gas-focused E&Ps have dealt with stagnant prices for a while, so they “have had more time to adjust their drilling activity lower.”

U.S. Capital Advisors’ Becca Followill, head of equity research, said everyone is in a “waiting mode” for now, “to see when schools, offices, places of worship and restaurants will reopen,” as well as to hear about “the second, third and fourth round of E&P capex cuts and how deeply they will curtail/shut in production…”

It’s also a wait-and-see for how “fast and hard” production is going to roll over, as well as to determine which E&Ps may succumb to bankruptcy.

“Oil’s loss is natural gas’ gain, but with gas-levered E&Ps still with wounded balance sheets, we see the nice move in the gas forward curve more as staving off bankruptcy and providing some free cash flow to pay down debt through 2021, rather than as a signal to increase activity,” Followill said.

[Want to see more earnings? See the full list of NGI’s 1Q2020 earnings season coverage.]

Evercore ISI analysts led by Stephen Richardson said the first quarter is going to be an ugly one as the “shine” wears off from the agreement to reduce oil production by members of the Organization of the Petroleum Exporting Countries and its allies (OPEC-plus).

“While we haven’t found anyone that is ”back up the truck’ bullish, global oil price reaching shut-in economics for marginal barrels is constructive as this is about as bad as things get for the oil patch,” Richardson said.

Oil-directed ConocoPhillips, Continental Resources Inc. and Cimarex Energy Co. were among the first to begin shutting in oil wells across the Lower 48, which has “helped assuage concerns that producers would run the car off the tracks here.”

The upstream sector, however, faces likely two more quarters of pain, Richardson said, but “plenty of unknowns likely remain.”

The “elephant in the room is how much will be voluntarily and involuntarily curtailed and for how long as supply chains adjust to the evaporation of product demand and growing inventories,” he said.

When West Texas Intermediate prices plunged below zero on Monday (April 20), it likely was a wakeup call for E&Ps, said Goldman Sachs analysts.

The price rout compartmentalized the need for U.S. oil curtailments, and it reinforced Goldman’s view that “a fragmented shale market structure based on boom-bust cycles and volume growth harms shareholder value.”

The oil and gas industry’s best corporate returns have come during periods of consolidation, financial squeezes and barriers to entry, according to Goldman.

“We believe this environment (and shareholder pressure for decarbonization) could engender a similar phase of consolidation and capital discipline, as in the late ”90s,” the Goldman analysts said.

“The only oil and gas development area that has not yet meaningfully consolidated is U.S. shale oil…In our view, fragmentation and largely scattered, noncontiguous shale acreage is preventing the industry under the current market structure from moving into its next phase of growth moderation, free cash flow generation and deflation through efficient logistics management,

infrastructure layout, ”Big Data’ and advanced analytics.”

Breakevens among the unconventional onshore E&Ps haven’t improved since 2016, Goldman’s analysts noted, while the rest of the industry has moved lower on the cost curve.”

Global gas is emerging as a long-term beneficiary in this period of underinvestment in our view, both in the U.S. (less associated gas production from shale oil)” and worldwide, as “all new” liquefied natural gas (LNG) developments have been postponed, leading to a constructive export market from 2022 through 2024.

Barclays Commodities Research analyst Amparpreet Singh said shutting in production from wells online is difficult. “But something’s gotta give, and sustained low prices might not leave producers with any other viable option.”

Smaller, private E&Ps stand to bear the brunt of the pain, as they control nearly “40% of the combined Texas, North Dakota and New Mexico production, according to data from Evenrus, and have relatively limited flexibility in marketing ability,” Singh noted.

“Smaller scale and less efficient operations mean these producers generally have cash costs of production in excess of the average $10-12/bbl for Lower 48 onshore output; spot prices in the Permian and Bakken regions are already below that level.”

A reversal in high oil storage levels at the Cushing hub is inevitable, but when that may happen, i.e. when demand returns, remains a question.

The analyst team at Tudor, Pickering, Holt & Co. (TPH) expects the next few weeks “to be more about getting through the next few months rather than looking back on first quarter results.”

The quarterly calls give E&Ps an opportunity to flesh out the “capex cadence and production impacts” through the rest of the year, but “the collapse in near-term crude price should also prompt conversations around shut-ins.

“What’s negative for oil can be positive for gas,” though, said the TPH analysts, with 6-7 Bcf/d estimated to be associated gas with oil cuts, “and we see the natural gas forward curve rising higher through the year,” measured by a “capital-discipline mantra from gas operators.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |