Weekly natural gas cash prices were mixed as continued declines in production and pockets of strong demand empowered bulls, but weakness in West Texas kept bears in that region on the prowl.

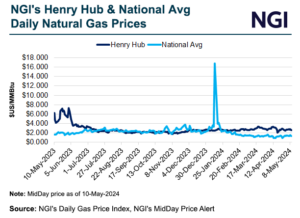

NGI’s Weekly Spot Gas National Avg. for the May 6-10 period rose 4.0 cents to $1.425/MMBtu.

Futures, meanwhile, rallied much of the week. The June Nymex contract settled at $2.252 to close the trading period on Friday, down 4.9 cents on the day but up 5% from the prior week’s finish.

“The front-end of the Nymex Henry Hub natty curve is on fire,” said analysts at The Schork Report.

On the physical market front, chilly conditions in the Mountain West and heat in the South galvanized rounds of both cooling and heating demand during the covered period. As the trading week closed,...