Markets | NGI All News Access | NGI Data

Bulls Seize the Reins Following Storage Report

Natural gas futures rose following the release of government storage figures that were somewhat less than what the market was expecting.

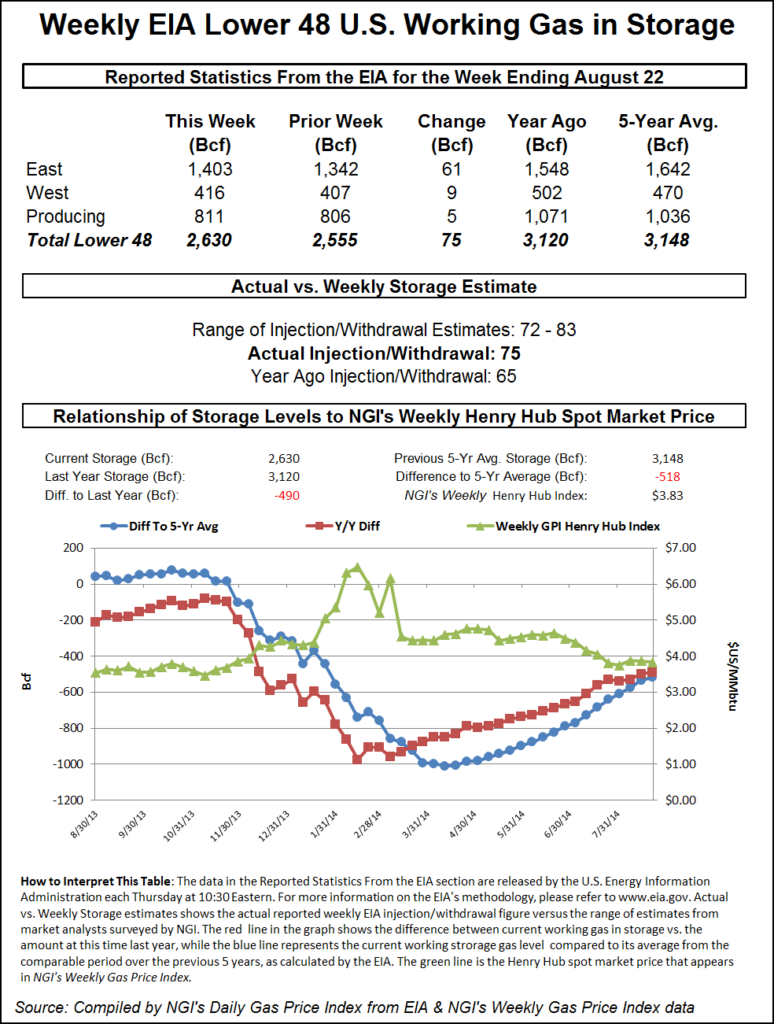

The injection of 75 Bcf for the week ended Aug. 22 that was reported by the Energy Information Administration in its 10:30 a.m. EDT release was about 3 Bcf less than market surveys and independent analyst projections. October futures rose to a high of $4.101 soon after the number was released and by 10:45 a.m. October was holding $4.051, up 4.8 cents from Wednesday’s settlement.

Prior to the release of the data analysts were looking for a build of approximately 78 Bcf. A Reuters survey of 24 traders and analysts revealed an average increase of 78 Bcf with a range of 72-83 Bcf. IAF Advisors was looking for a build of 80 Bcf, and Bentek Energy’s flow model anticipated an injection of 76 Bcf.

“We had heard from 78 Bcf to 80 Bcf or thereabouts, and I think the market will hold $4 initially, but I don’t think the market has a lot of strong support [above $4] at all,” said a New York floor trader. “If we settle above $4, that might have some significance, but if we trade back down then we are looking at a trading range of $3.75 to $4.25.”

Phillip Golden, director of risk and product management at EMEX, said the storage report was “relatively flat” versus market expectations of 76-80 BCF. “The market is up slightly, continuing [Wednesday’s] trend and suggesting that weather, rather than the storage report, is moving the energy market right now,” he said. “Due to recent movements in the market, the balance of calendar year 2014 is now at the high end of the EMEX’s expectations. However, as previously stated, EMEX believes there will be buying opportunities for consumers in the next six weeks, and businesses should be prepared to capture these dips in energy prices before winter arrives.”

While noting that 2014 remains the strongest injection season in the past six years, Golden added that injections going forward could fall off the record refill pace, thanks in large part to the recent heat wave striking much of the country. “With what appears to be a late-onset summer, the potential for injection numbers to remain flat or decline slightly week-over-week exists and would be contrary to historical norms,” he said.

Inventories now stand at 2,630 Bcf and are 490 Bcf less than last year and 518 Bcf below the five-year average. In the East Region 61 Bcf was injected, and the West Region saw inventories up by 9 Bcf. Inventories in the Producing Region rose by 5 Bcf.

The Producing region salt cavern storage figure fell by 4 Bcf from the previous week to 210 Bcf, while the non-salt cavern figure rose by 9 Bcf to 601 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |