Markets | NGI All News Access | NGI Data | NGI The Weekly Gas Market Report

NatGas Futures Return to Orbit; 230 Bcf Draw Inline With Expectations

Backing off Wednesday’s round of over-exuberant short-covering that saw both February and March futures soar by 52.4 cents, the newly minted front-month contract was in full retreat Thursday as the current polar vortex eased and forward-looking weather forecasts also moderated.

After March futures dropped more than 30 cents in morning trade, the Energy Information Administration’s (EIA) 230 Bcf storage withdrawal report for the week ending Jan. 24 only offered up a speedbump to the screen’s decline as the number was deemed to be inline with expectations. At the end of the regular trading session, March natural gas had given back 45.4 cents of Wednesday’s gains to close at $5.011.

In the physical market, trading was mixed for Friday delivery, with gains in the western half of the United States ranging mostly from a dime to more than 20 cents, while a number of key eastern market locations continued to come off of their polar vortex-induced perches, declining by $5 or more.

BNP Paribas’ Teri Viswanath said Thursday it appears that the volatility that was prevalent in natural gas prices during the 1990s and early 2000s is returning. “It has long been assumed that the dramatic increase in U.S. natural gas resources would prevent high prices and volatility from returning. And yet, this winter has witnessed all-time record high prices for spot gas deliveries, raising questions on whether pipeline constraints have introduced a level of artificial tightness in the industry.”

How this recent price volatility will impact February bidweek remains to be seen. “Over the last few weeks we’ve seen prices move in wide swings as these extreme cold fronts seem to arrive every other week,” said a Northeast marketer. “I think storage levels will come into play for a lot of traders seeing as how we now have roughly 450 Bcf less than the five-year average in the ground. I think concern could be growing for end-of-season inventories, and it will be interesting to see whether we get a reprieve from this cold in February.”

Late last week, a number of energy analysts contacted by NGI acknowledged that U.S. gas storage levels could fall to 1.2 Tcf by the end of withdrawal season, which could boost prices through the first half of the year (see Daily GPI, Jan. 24). It depends on just how much more deep freeze cold this winter has left.

Much of the purple signifying well below normal temperatures is absent from the National Oceanic and Atmospheric Administration’s latest six- to 10-day forecast map, and the warm-up was evident in the latest round of freeze-off stats from industry consultant Genscape. Using production from Jan. 20 as a benchmark, total freeze-offs Thursday amounted to 1,075 MMcf, down from Wednesday’s 1,228 MMcf. Three locations were still seeing freeze-offs of more than 300 MMcf from the Jan. 20 production level, including the Gulf of Mexico (398 MMcf), West Virginia (333 MMcf) and Northeast Pennsylvania (314 MMcf).

While the Great Lakes region and much of the Midwest is still expected to see well below normal conditions in NOAA’s near-term forecast, most other locations — including the Northeast — are expected to see slightly below normal to normal conditions for this time of year.

Forecasters predict a near term warm-up for the greater New York area. “The worst of the recent cold and perhaps the coldest days of the winter may be behind the New York City area. However, there are some storms on the horizon,” said Alex Sosnowski, AccuWeather.com meteorologist. “A pattern change will take away the pure arctic flow of air to allow milder Pacific air to mix in during the last few days of January and into February, [and] through at least the first half of February, nighttime lows in the single digits and highs in the teens are not likely for the city.

“Temperatures will trend toward the 30-year average or a tad above average late this week into the big football weekend. The average high and low for late January/early February is 39 and 27 F, respectively. Average temperatures begin to trend upward during February. While dry weather is in store through Friday, a series of storms will affect the region Saturday through Wednesday. The first two or three systems will be weak, with light precipitation, but the caboose in the short train could be strongest and bring heavy precipitation.”

Reflecting the more immediate warm-up, Transco Zone 6-NY came off $7.91 on Thursday for Friday delivery to average $6.35, while Transco Zone 5 dropped $6.10 to average $6.18. Farther north into New England, some locations were holding on to some of their premiums. Algonquin Citygates declined by $4.31 on Thursday but still averaged $10.57.

Moving west, gains could be found. Chicago Citygate picked up a penny to average $6.44, while in the Rockies, Kern River added 23 cents to average $5.27. In California, SoCal Citygate gained 18 cents to $5.44, and PG&E Citygate added 17 cents to average $5.41.

Thursday’s storage withdrawal report was on the low end of expectations, which ranged from 220 Bcf to 280 Bcf, and traders had already been putting downward pressure on prices Thursday morning following Wednesday’s run-up.

In the minutes prior to the 10:30 a.m. EST report’s release, March natural gas futures — in its first action as the front-month contract — was trading at $5.138, well below Wednesday’s $5.465 settle. While the 230 Bcf draw was on the low side of expectations, it proved to be enough to at least temporarily halt the price freefall. In the minutes that immediately followed the report, March gas jumped back above $5.200 before retreating once again.

“The 230 Bcf net withdrawal was neutral relative to market expectations but bullish compared with the 162 Bcf five-year average for the week,” said Tim Evans of Citi Futures Perspective. “It also affirms a supportive background supply-demand balance that points to ongoing withdrawals above the five-year average rate.”

Explaining Thursday morning’s pullback in natural gas futures values, Viswanath said traders were looking at the bigger picture. “Once again, the weekly storage release was subordinated to more expansive discussions on the balance of winter with the warm-up in overnight weather models suggesting weaker demand ahead.”

Heading into the report, all expectations were for a withdrawal well in excess of last year’s 191 Bcf pull and the five-year average withdrawal of 162 Bcf. IAF Advisors of Houston calculated a pull of 236 Bcf, and a Reuters poll also showed a 236 Bcf withdrawal. Evans hit the nail on the head with a 230 Bcf draw prediction.

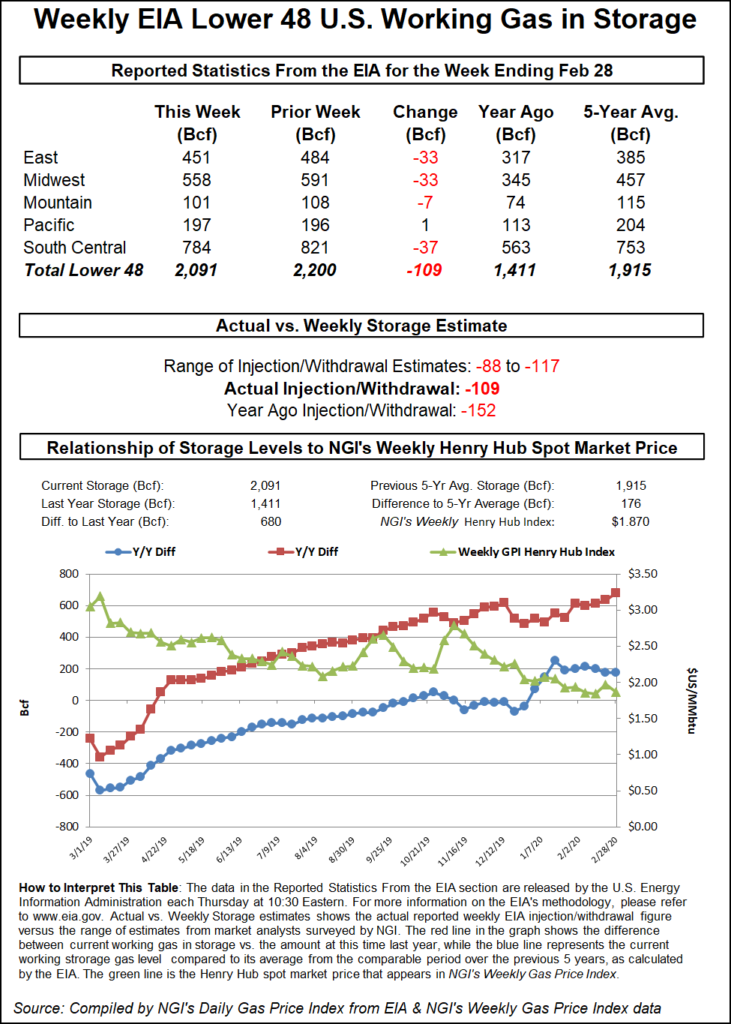

As of Jan. 24, working gas in storage stood at 2,193 Bcf, according to EIA estimates. Stocks are now 637 Bcf less than last year at this time and 437 Bcf below the five-year average of 2,630 Bcf. For the week, the East Region withdrew 124 Bcf, while the Producing Region removed 84 Bcf and the West Region dropped 22 Bcf.

The Producing region salt cavern storage figure declined by 27 Bcf from the previous week to 186 Bcf while the non-salt cavern figure fell by 57 Bcf to 617 Bcf. For the second week since the EIA began publicly tracking the implied flow of gas, the implied flow in each region matched the net change in inventories.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |