Shale Daily | E&P | Haynesville Shale | NGI All News Access | Permian Basin

Black Stone Selling Permian Mineral, Royalty Interests to Pay Down Debt

Black Stone Minerals LP said Thursday it has two agreements to sell certain mineral and royalty interests in the Permian Basin for about $155 million.

Combined oil and natural gas production from the properties to be sold stands at an estimated 1,800 boe/d, Black Stone said.

Proceeds are to go toward paying down the Houston-based firm’s revolving credit facility, with total debt expected to be under $200 million once the transactions are closed.

One agreement in West Texas, which Black Stone expects to complete in July, involves selling interests in Midland County to a private buyer for about $55 million gross.

The other entails the sale of a 57% undivided interest across parts of Black Stone’s Delaware sub-basin position and a 32% undivided interest across its Midland position to Pegasus Resources LLC, for about $100 million gross.

Pegasus is a portfolio company of EnCap Investments LP, a Houston-based venture capital firm.

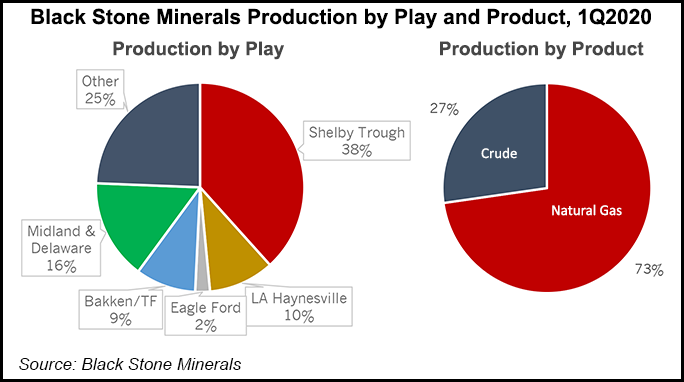

Black Stone, which owns mineral and royalty interests in 41 states, said in May it was restarting development of its Shelby Trough acreage in the East Texas portion of the Haynesville/Bossier Shale in a deal with Aethon Energy.

Shut-in production of oil and associated gas in basins such as the Permian in response to the demand impacts of Covid-19 is expected to bolster natural gas prices by 2021, making the economics of dry gas plays such as the Haynesville more attractive for operators, Black Stone management said last month.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |