NGI Weekly Gas Price Index | Markets | NGI All News Access | NGI Data

Weather Drives Big Moves for Weekly Natural Gas Spot Prices

Spot natural gas prices came roaring back for the first week of May, driven higher by cooling demand from the West Coast to the Southeast and heating demand in the Midwest and East. An surge in futures early in the week also lent support to markets, with the NGI Weekly Spot Gas National Avg. rocketing some 20.5 cents higher to $1.750.

With temperatures soaring into the 90s and even low 100s in some areas of California and the Desert Southwest, prices rallied throughout the region. The most significant gains were seen at SoCal Citygate, which jumped 48.0 cents week/week to average $2.095. Prices farther north also posted notable increases but stayed below the $3.00 mark.

Most markets across the Rockies were up more than 20.0 cents week/week, as were several in the Midcontinent and Midwest. However, Chicago Citygate cash prices averaged the week just 16.5 cents higher at $1.845.

Gains across Texas were led by the Permian Basin, where Waha averged $1.635, up 24.5 cents week/week. Most other increases across the state were capped at around 20.0 cents.

Mobius Risk Group said that given the continued strength at Waha, there are likely some significant reductions in associated gas supply in West Texas, yet the weekly government storage inventory numbers and daily storage data argue that “any supply shortfall is not yet rippling through the broader U.S. market in terms of a supply/demand impact.”

Markets across Louisiana and the Southeast saw gains capped at around 20.0 cents, while in Appalachia, Dominion South spot gas prices climbed just 8.0 cents week/week to $1.445. Transco Zone 6 NY was up 16.0 cents on the week to average $1.510.

Natural gas futures came under pressure during the May 4-8 period as demand, already soft due to ongoing shutdowns amid the coronavirus pandemic, was set to fall even further as mild spring weather started spreading across much of the country.

After starting the week just a hair below $2.00, the June Nymex fell to $1.823 by Friday, off about 7 cents day/day and around 17 cents from Monday. July slid roughly 15 cents on the week to $2.077.

Much like the past month, volatility remained high. Colder trends in the weekend models that carried over into Monday lifted the June contract by 10 cents that day, while an explosion on Texas Eastern Transmission later that evening sent prices higher overnight and throughout Tuesday’s session. The prompt month soared as high as $2.162 but eventually settled a few cents below that level.

Supplies were largely rerouted by Wednesday, and armed with a triple-digit storage injection, natural gas bears sent the June contract lower for the remainder of the week.

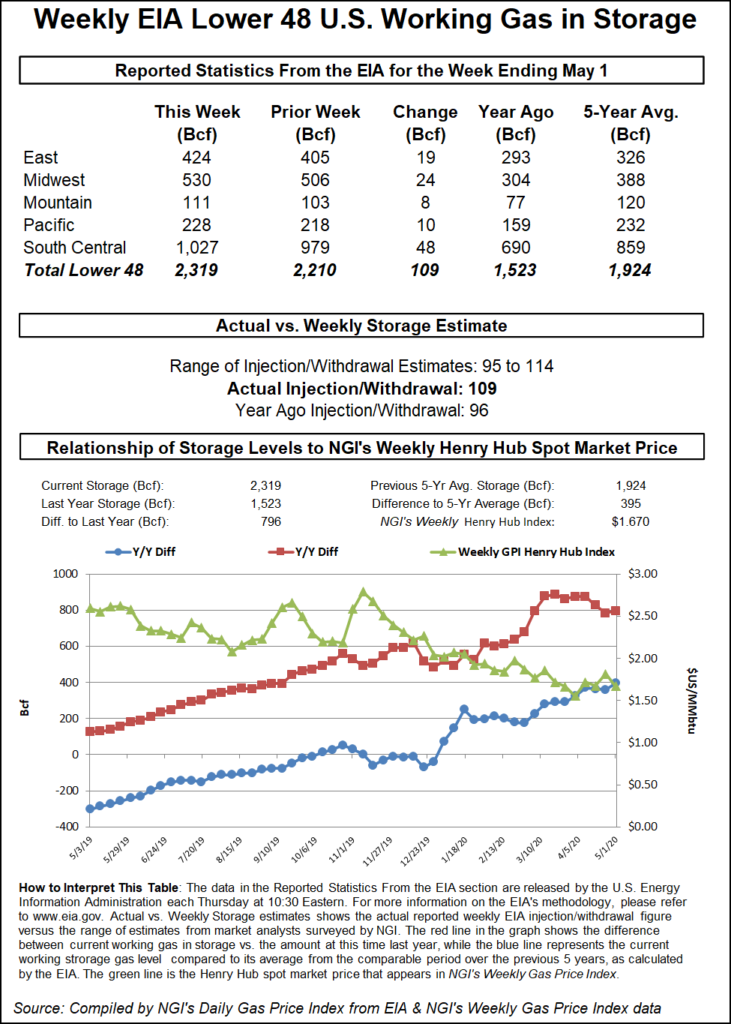

The Energy Information Administration (EIA) reported a hefty 109 Bcf injection for the week ending May 1, easily beating historical figures and expanding the storage overhang. Inventories rose to 2,319 Bcf, 796 Bcf above year-ago levels and 395 Bcf above the five-year average, according to EIA.

Broken down by region, the South Central region led with a 48 Bcf build, which included a 31 Bcf injection into nonsalt facilities and a 17 Bcf build in salts, according to EIA. The Midwest added 24 Bcf into storage, and the East added 19 Bcf. Pacific inventories grew by 10 Bcf, while Mountain region stocks rose by 8 Bcf.

Market observers noted that only 70 Bcf of capacity remains available in salt storage facilities in the South Central region before it’s maxed out. On The Desk’s social media platform Enelyst.com, Managing Director Het Shah said that with gas flows being redirected to Midwest and East storage locations following the Tetco blast, he expects the salt storage build to be lower in the next EIA report. Mobius Risk Group said early indications show that “at least” another 10 Bcf has been injected this week.

Meanwhile, heat has been slow to build in the region, with the latest weather models maintaining a strong cold pattern in the Midwest and East for the next few days, including potential record lows this weekend in some areas, according to Bespoke Weather Services. However, late next week, the pattern is seen changing to one in which warmer air returns into the eastern half of the country, while the West cools down.

This is still more prominent in the European model, Bespoke said. “Such a pattern will not boost demand much yet, as it is late May into June when above-normal temperatures begin to move to the bullish side of the spectrum, but we do expect a few more gas-weighted degree days than the models show, thanks to southern warmth.”

Liquefied natural gas (LNG) demand also remains bearish. Already around 30 U.S. cargoes have been canceled for June, according to shipbroker Poten & Partners, and analysts say cancellations could continue into the fall. Energy Aspects said global gas benchmarks are in steep contango for the coming months and further downside is possible for Dutch Title Transfer Facility prices in the third quarter as European storage nears capacity.

“Europe is in the process of lifting some of its Covid-19 lockdowns, but demand will naturally remain weak in the coming months because of residual social distancing measures and economies falling into recession,” Energy Aspects said.

The extension of lockdowns in India and Japan in recent days are projected to further weaken global LNG demand in the coming weeks, according to the firm, although this is more apparent in India than in Japan. This points to continued U.S. cargo cancellations even as facilities are still being commissioned.

“However, the high point for cargo rejection will likely be reached in June-July, with potential fuel switching in Northeast Asia and floating storage providing an outlet for LNG exports in late summer,” Energy Aspects said.

Despite the potential for record-breaking low temperatures in the East, spot gas prices cratered on Friday. In fact, even with some cities forecast to have chillier temperatures on Mother’s Day than they had on Christmas, the Northeast posted some of the largest declines for gas delivered through Monday.

The National Weather Service (NWS) said that along and east of the Mississippi River, an Arctic air mass is expected to usher in cold temperatures and blustery conditions this weekend. “Numerous” freeze watches and warnings were posted from the Midwest to the Northeast, with record low temperatures possible, most notably Saturday morning, according to the forecaster.

“In addition to the winter-like temperatures, parts of the Great Lakes, Appalachians and Northeast will witness wintry precipitation” into Saturday as a surface low pressure system rapidly intensifies off the New England coast, NWS said. “Snow could fall heavily at times, with several inches of accumulating snowfall possible in the northern and central Appalachians.”

Despite the chilly outlook, Transco Zone 6 non-NY cash tumbled 21.5 cents to average $1.365 for gas delivered through Monday, while Tennessee Zone 6 200L fell 19.5 cents to $1.475.

Markets across Appalachia put up similarly steep declines for the three-day gas delivery, while Southeast prices fell around 10 cents or so day/day.

Starting on Saturday and continuing through May 18, East Tennessee Pipeline will conduct a hydrostatic test on its 3100 Mainline from the Clark Range to Wartburg compressor stations, both located in Tennessee. During this time, capacity through Clark Range is to be reduced to zero.

“Flows through Clark City have averaged 96 MMcf/d and maxed at 134 MMcf/d over the last two weeks, and flows have been trending upwards due to demand from the cold snap in the East,” Genscape analyst Josh Garcia said.

The analyst noted that East Tennessee will allow this isolated segment between Clark Range and Wartburg to flow bidirectionally and source gas internally, as there is only 1 MMcf/d of net demand on this segment. Furthermore, the Southern 3200 Line has ample available capacity and could be used to flow the missing supply up to serve demand on the 3300 Line heading to Northeast Tennessee and Virginia, Garcia said.

In the country’s midsection, spot gas price declines were in line with the East, sliding north of 10.0 cents day/day. Chicago Citygates cash was down 18 cents to $1.690, and OGT was down 10.5 cents to $1.600.

Similar losses extended across Texas, except in the western part of the state. El Paso Permian averaged $1.535 for gas delivered through Monday, up 4.0 cents day/day.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |