Shale Daily | Coronavirus | E&P | Markets | NGI All News Access

Stalled Transportation Fuel Demand Slowing Refinery Activity, Says EIA

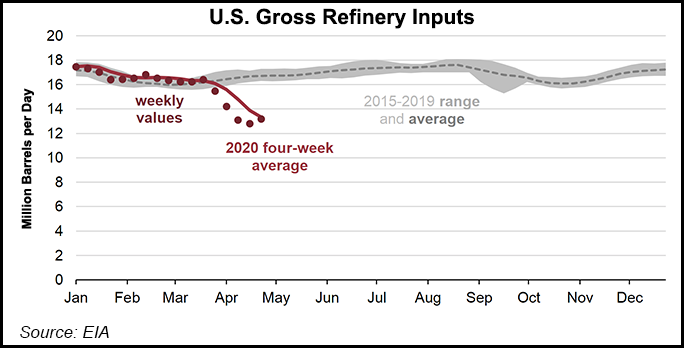

Impacts of coronavirus mitigation efforts continue to reverberate through the economy, with a decline in transportation fuel demand since early March prompting a nearly 21% decline in crude oil and other inputs at refineries compared with the previous five-year average for this time of year, according to the U.S. Energy Information Administration (EIA).

Such refinery runs fell for four consecutive weeks to 12.8 million b/d in the week ending April 17 before increasing slightly to 13.2 million b/d for the week ending April 24, EIA said.

Finished motor gasoline consumption was 5.1 million b/d in the week ending April 3, the lowest recorded since EIA began tracking the date in 1991. Gasoline product supplied has increased to 5.9 million b/d since then – still 37% below the previous five-year average for this time of year.

Jet fuel product supplied set a record low during the week of April 10, falling to 463,000 b/d, EIA said. But while jet fuel product supplied increased during the past two weeks, averaging 800,000 b/d for the week ending April 24, it remained 51% lower than the previous five-year average.

Demand for distillate was initially not as impacted, remaining near the five-year average through April 3. But during the week of April 10 distillate product supplied fell to 2.8 million b/d, its lowest level in 21 years, and averaged 3.2 million b/d for the week ending April 24.

“As refinery runs have fallen, refiners have also changed the mix of petroleum products they are producing,” EIA said. “Normally (based on the 2019 average), a barrel of crude oil and other inputs will yield 51% motor gasoline, 31% distillate, and 11% jet fuel. U.S. refiners have recently decreased their production of motor gasoline and jet fuel and increased their production of distillate.”

There may be some light at the end of the tunnel, however. Valero Energy Corp., which manufactures and markets transportation fuels, began to see improvements in fuel demand in the second half of April, a gradual recovery that is expected to improve as the economy comes back to life following severe Covid-19 restrictions.

Valero is seeing a near 9% increase in gasoline demand from early April, with the pickup mostly in the Midcontinent and the Gulf Coast regions, where some of the stay-at-home orders were being slowly lifted. High-demand states, including Texas and Florida, were partially lifting stay-at-home orders, allowing retail stores and restaurants to open to limited customer traffic.

Still, global energy demand could plunge 6% this year, including a 5% drop for natural gas, marking the steepest declines in 70 years, the International Energy Agency (IEA) said in a report Thursday. The projected overall energy tumble — hastened by falloff in commercial and industrial demand as 4.2 billion people around the world are living in some form of lockdown to slow the spread of the coronavirus — would dwarf by seven-fold the drop caused by the 2008 financial crisis.

Consumption of petroleum products in the United States fell to 13.8 million b/d in the week ending April 10, the lowest level since at least 1991, EIA recently reported. U.S. petroleum consumption rebounded slightly in the week ending April 17 to 14.1 million b/d. Even that amount was 31% lower than the average had been through mid-March, when travel restrictions and other Covid-19 mitigation efforts began to go into effect, EIA said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |