NGI The Weekly Gas Market Report | Markets | NGI All News Access

Mexico Natural Gas Demand Down in April, but Coronavirus Impacts Still Unclear

Natural gas demand in Mexico hasn’t fallen remarkably because of government and business efforts to combat the Covid-19 outbreak, although it’s still very early to tell, according to an analysis by Mexico City-based energy consultancy Gadex.

“We know that April demand is down compared to March, but that always happens during Easter week,” Gadex director Eduardo Prud’homme told NGI’s Mexico GPI.

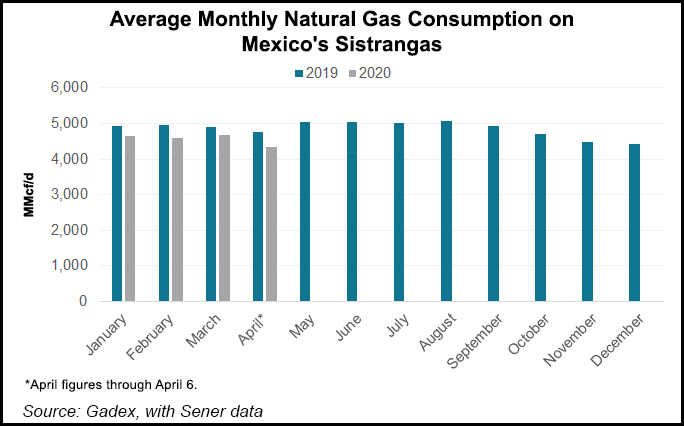

Gadex figures show that April demand through April 6 on the Sistrangas natural gas pipeline network averaged 4.333 Bcf/d, compared to March demand of 4.673 Bcf/d and April 2019 demand of 4.763 Bcf/d.

On a yearly comparison, gas demand fell in each of the first three months of 2020 from January through March 2019.

Consumption on the Sistrangas fell to 4.648 Bcf/d in January, compared with 4.937 Bcf/d in January 2019; February demand was down to 4.583 Bcf/d, versus 4.957 Bcf/d in the year-ago month; while March consumption fell to 4.673 Bcf/d from 4.903 Bcf/d.

Lower economic activity, according to Gadex analysts, is having a greater impact on the sector this year than any other factor.

Mexico saw marginally negative economic growth in 2019, and the year started off poorly. Industrial activity in Mexico fell 3.5% year/year in February, according to statistical agency Instituto Nacional de Estadística y Geografía, but this could seem quaint in comparison to what’s in store. Recently, analysts at BofA Global Research said they are forecasting a contraction of 8% for Mexico’s economy in 2020.

That said, natural gas in the industrial sector actually rose in March, climbing slightly to 1.016 Bcf/d, compared with 1.003 Bcf/d a year ago. Through April 6, gas use in the industrial sector was 985 MMcf/d. It averaged 942 MMcf/d in April 2019.

In Sistrangas Zone 3, which covers the industrial hub in northern Nuevo León and is by far the most gas-intensive area in Mexico, April demand has been 2.674 Bcf/d, compared with 3.502 Bcf/d in the year-ago month.

In March, confirmed injections in Zone 3 fell to 3.372 Bcf/d, compared with 3.534 Bcf/d in March 2019.

Gas to the power sector — the biggest user of natural gas in Mexico — is also down in all four months of the year. Power sector gas demand fell to 1.433 Bcf/d in March from 1.709 Bcf/d in March 2019. In the first six days of April, it averaged 1.299 Bcf/d. Power sector demand averaged 1.646 Bcf/d in April 2019.

UNDERSTAND MEXICO PIPELINES: Pre-order NGI’s Mexico Pipelines, Market Points & LNG map today.

“Normally in April we see a change in tendency, as the months get hotter and natural gas demand picks up,” Prud’homme said. “This year it hasn’t happened so far. We are not sure about what sort of seasonality we will see this year.”

In the United States, the first signs of deep demand impact of the coronavirus are starting to be seen. On Thursday, the U.S. Energy Information Administration (EIA) reported a 38 Bcf injection into natural gas storage inventories for the week ending April 3, a larger-than-expected build.

“Demand is getting killed,” said Genscape Inc. senior natural gas analyst Eric Fell, who said that not all of the demand loss resulting from Covid-19 shutdown measures were being captured by flow data. “You’ve got to look past pipeline nominations, although it helps to have infrared monitors on refineries, ethylene crackers, etc.”

Likewise, it might be a few weeks until the natural gas demand implications become clear in Mexico. Mexico imposed stay-at-home measures on March 30, when the administration ordered the closing of all nonessential businesses through April 30 and urged citizens to stay home.

As of Thursday (April 9) , Mexico had 3,181 confirmed cases of coronavirus, with 174 deaths, according to Johns Hopkins University. Mexico’s Health Minister Jorge Alcocer said on Wednesday that because of low levels of testing, the actual number of cases is probably eight times higher.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 |